April was a turbulent month for markets. Having begun 2024 with an abundance of enthusiasm about the prospect of (very near) interest rate cuts from central banks, an improving economy both domestically and abroad, and resilient employment, 2024 promised the fulfillment of a long-held dream; for the central banks of Canada and the United States to tackle inflation without causing a recession.

Though recessions seem to not be lurking in the immediate vicinity, the best-case scenario for the year is now fully off the table. Several months of higher-than-expected inflation numbers have caused markets to reconsider their earlier optimism and contemplate some of the more pessimistic predictions for economies.

In turn, US markets shed several percentage points through the first two weeks of April, not wiping out the year’s gains but reducing them by about half. Bond markets, having placed bets on rate cuts and longer duration bonds have retreated as well, wiping out gains for the year and forcing bond traders to retrench into safer, shorter duration positions.

Markets have steadied since then, and have been encouraged by Jerome Powell’s statements that the Fed still intends to cut rates, but the earlier optimism about many cuts totalling more than 1% for the year seem unlikely, and even now we will need more data in the coming months to trigger the first cut that had been anticipated for the early year.

Why is this, and why have markets been so easily convinced that rates were bound to fall so quickly?

There’s no obvious single answer. Like many issues surrounding complicated problems a multitude of events, including human bias and the best of intentions have formed the foundations for a great deal of misunderstanding. For the Fed’s part, it has remained committed that data will drive all interest rate decisions, a sensible argument but one that has tied their hands. Investors and analysts have shown a natural bias of optimism, and have assumed that with the bulk of inflation easily defeated through 2022 and 2023 that the final pieces would fall easily into place. This optimism has not learned from the recent past, as 2023 began in much a similar way, with anticipation of rate cuts happening in the second and third quarter of the year only to have rates start increasing in May.

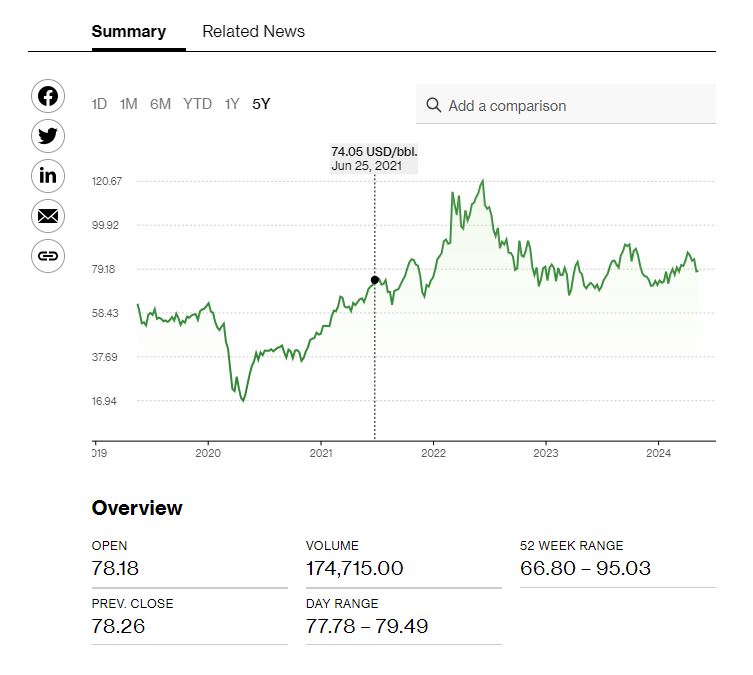

But after these more human problems, what remains are a series of headwinds that will likely be with us for the foreseeable future. While prices of many commodities have fallen from their peaks, and “supply chain constraints” are no longer choking the global trade network, the world is fundamentally different than its was before 2020. China’s relationship with the West is now more openly antagonistic, and a combination of “reshoring” or “friend shoring” is ensuring that costs will be higher than they were in the past. Food prices have continued to rise, with sometimes opaque reasons. In some instances there are clear justifications for higher costs, like bird flu affecting American egg prices or higher gas charges pushing up the cost of shipping. But other times it seems that prices have risen because grocery stores simply can. Finally, commodity prices, while lower than they were in 2021/2022, remain above pre-covid levels. This applies especially to the price of energy, which seems set to stay elevated for the near term.

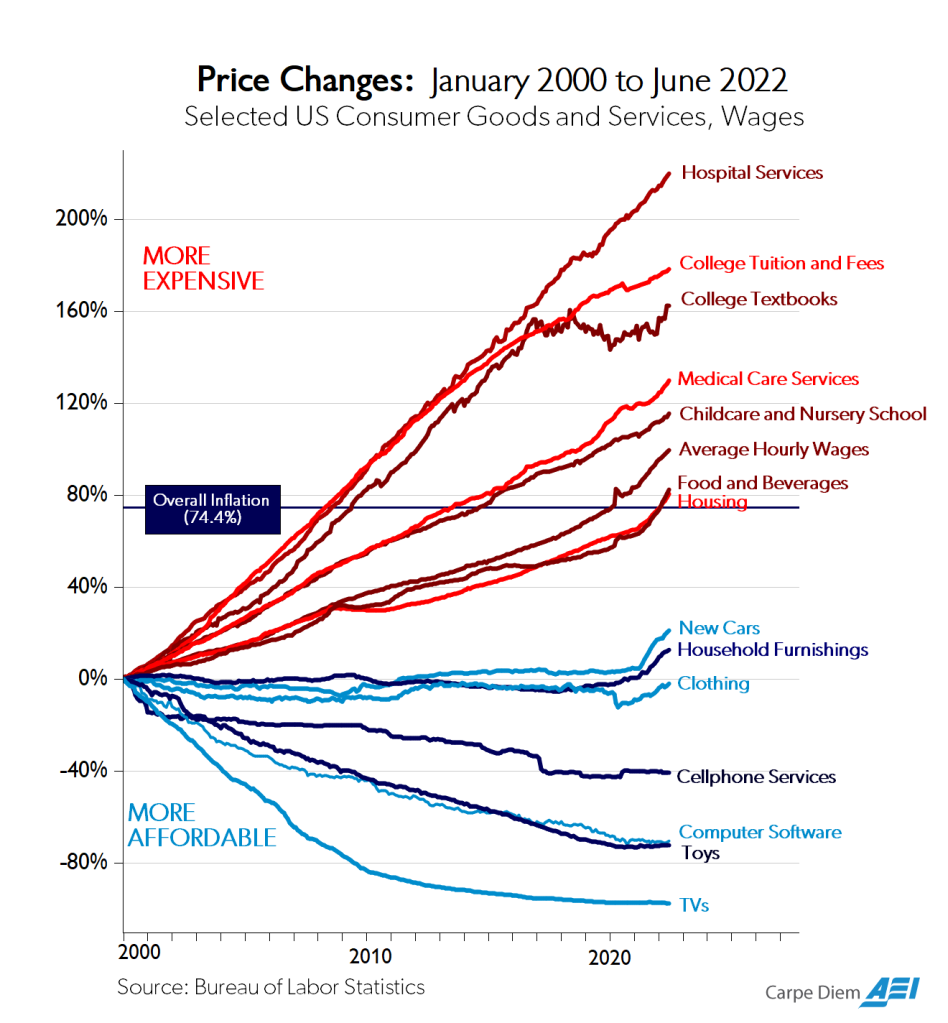

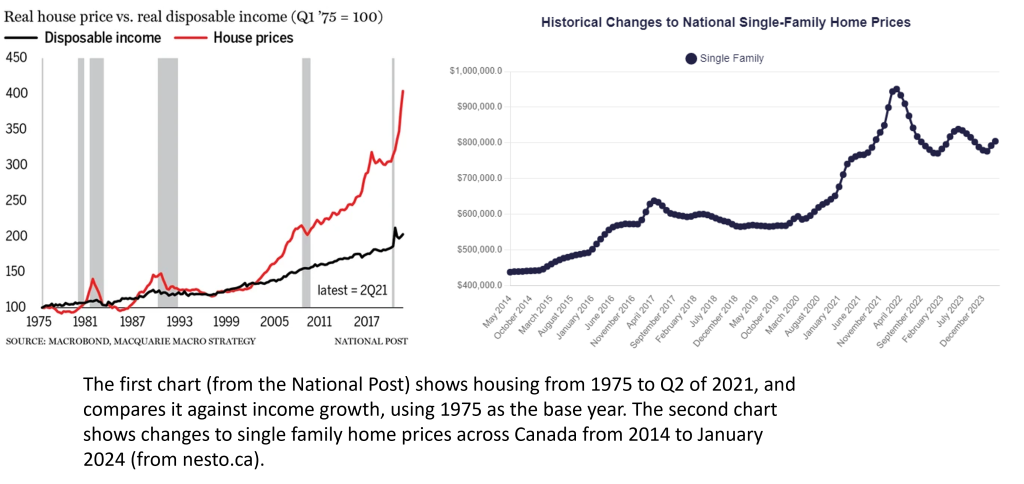

Underlying this remains some larger issues about inflation’s presence in our lives before 2020. As I’ve previously written, many parts of our society were experiencing inflation long before CPI began to worry economists and other experts. Prices of physical goods had been falling for decades, but price of homes, child care, education, and food had all been climbing over that same period. The price of housing might be better if governments took a more active role in getting the cost of development down, but permits and other government fees now account for anywhere between 20% (CMHC estimates) to 60% when all taxes, red tape, permit costs and development charges are accounted for, a lucrative source of funds for municipal budgets.

Source: https://www.aei.org/carpe-diem/chart-of-the-day-or-century-8/

Additionally, since 2008 interest rates had been at “emergency levels”, the lowest borrowing costs of any time in history. Those near zero rates, which were intended to help remove slack from the economy and encourage large capital expenditure instead stimulated enormous share buybacks among major corporations. Instead of new jobs and a hotter economy we got increasing share prices and more corporate debt.

Problems that take a long time to form do not get fixed quickly. Repeatedly markets have shown an impatience for corrections and are quick to assume that pauses in inflation must mean that the trend of higher prices has both been beaten and that interest rates can fall back to previous emergency levels. Even if interest rates are at sufficient levels to regain control over the direction of inflation, it still doesn’t mean that rates can fall quickly, and the longer rates stay elevated above the emergency levels of the past, the deeper and more costly current interest rates become to the economy.

In Canada low interest rates helped stimulate an enormous increase in property values through the 2010s and into the pandemic. Higher interest rates threaten those gains and as we go through 2024, almost 60% of mortgages will have renewed into more expensive loans since rates began climbing. Even if interest rates begin to fall, homeowners can expect that the cost of borrowing will be much higher than they’ve been for many years. Between the desire of home owners to keep house values high, municipalities to keep their tax bases stable, and banks to ensure that the value of properties they’ve underwritten don’t move too much, the pressure to get inflation down runs squarely into our own self interest.

The urgency and desire for lower interest rates are real, but so are the headwinds that keeps inflation pressure high.

Walker Wealth Management is a trade name of Aligned Capital Partners Inc. (ACPI)* – if applicable ACPI is regulated by the Investment Industry Regulatory Organization of Canada (http://www.iiroc.ca) and a Member of the Canadian Investor Protection Fund (http://www.cipf.ca). (Advisor Name) is registered to advise in (securities and/or mutual funds) to clients residing in (List Provinces).

This publication is for informational purposes only and shall not be construed to constitute any form of investment advice. The views expressed are those of the author and may not necessarily be those of ACPI. Opinions expressed are as of the date of this publication and are subject to change without notice and information has been compiled from sources believed to be reliable. This publication has been prepared for general circulation and without regard to the individual financial circumstances and objectives of persons who receive it. You should not act or rely on the information without seeking the advice of the appropriate professional.

Investment products are provided by ACPI and include, but are not limited to, mutual funds, stocks, and

bonds. Non-securities related business includes, without limitation, fee-based financial planning services; estate and tax planning; tax return preparation services; advising in or selling any type of insurance product; any type of mortgage service. Accordingly, ACPI is not providing and does not supervise any of the above noted activities and you should not rely on ACPI for any review of any non-securities services provided by Adrian Walker.

Any investment products and services referred to herein are only available to investors in certain jurisdictions where they may be legally offered and to certain investors who are qualified according to the laws of the applicable jurisdiction. The information contained does not constitute an offer or solicitation to buy or sell any product or service.