In 2016, Donald Trump supporters said that you should take him seriously, but not literally. His first press secretary, Anthony Scaramucci said “don’t take him literally, take him symbolically.” This defense of Trump was meant to highlight that while he may have said incredibly controversial things, much of that was just talk, and it was his message behind the words that you should really pay attention to.

But Trump himself has contradicted this view more than once, frequently saying “I don’t kid” when challenged on policy (the exact comment came about in 2020 over coronavirus testing). In other words, Trump has let people know that you shouldn’t be surprised when he does do things that seemed initially outrageous. For the wider world this has meant that you should take Trump at his word, and that even if some of his rhetoric is just that, rhetoric, you would be foolish to ignore the substance of his messages.

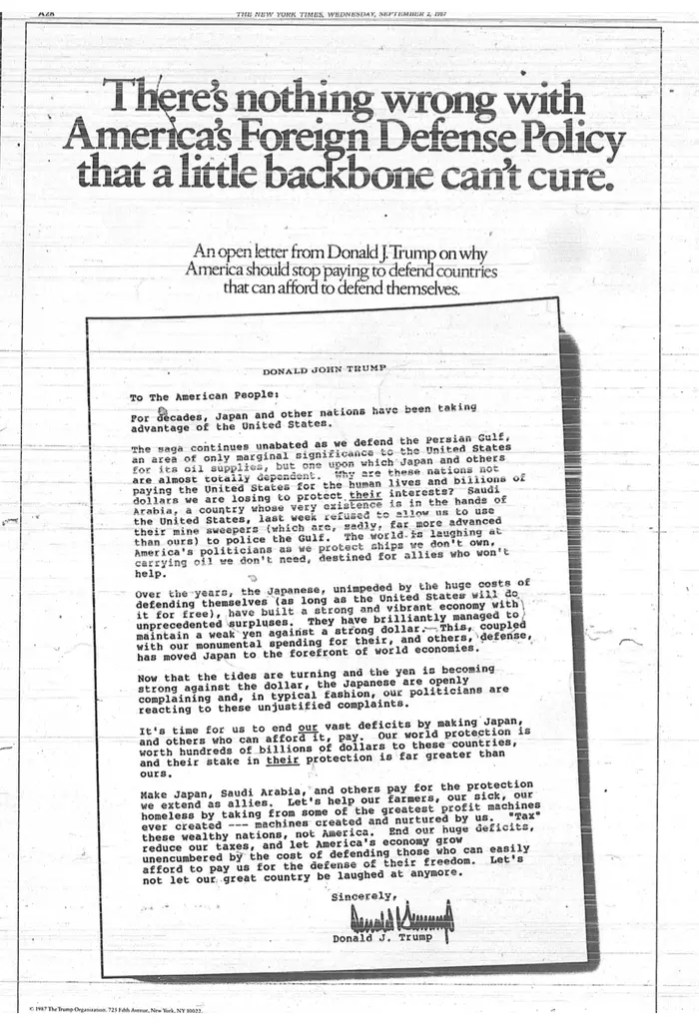

Since his re-election Trump’s focus has been squarely on tariffs, promising them on China (a further 10%), on BRIC nations (100%) and Canada and Mexico (25% each). He’s suggested that some of the tariffs can be avoided for Canada and Mexico over better border controls on drugs and illegal immigrants, but whether this is true is unknown. Political commentators like David Frum have pointed out that Trump’s views on trade have been consistent since his first considered run for the presidency in 1987, that he is hostile to trade and sees it as a zero-sum game.

In 2025 world leaders and policy shapers believe Trump should be taken both seriously and literally. While the current political situation in Canada has been turbulent, the view of the government and provinces is almost unanimous (Quebec and Alberta remain the perennial opponents to joining the band wagon). Doug Ford took the initiative to announce that Ontario could stop energy exports to the US in the event of a trade fight, a position seconded by BC’s premier David Eby.

But in the United States the threat of aggressive and expanding tariffs have also been taken literally, notably by Jerome Powell of the Federal Reserve. On December 18th, in a move that shook markets, Jerome Powell did announce a final rate cut for 2024, but stressed that future cuts were heavily dependent on inflation, which will likely rise if Trump enacts his regime of trading tariffs. Markets were quick to react, and though 2024 will be remembered as a pretty good year for investors, the speed and size of the market sell-off was newsworthy, being the largest since August.

The next morning and markets began on a relatively positive note, continuing a trend of brief panics followed by long yawns as markets simply resume their upward momentum. Little seems to have dissuaded the bull market since 2022 and with the US economy still showing itself to be very strong there’s every chance that the brief panic on December 18th was just that, a moment of panic at the end of 2024. But Trump, like the rest of us, doesn’t live in longer and slower news cycles. Instead market panics live on in social media, and run the risk of coalescing into counter narratives that Trump might hurt the economy more than help it (its notable that the economy has been very strong under Biden, but that didn’t change the perception that Trump had been the better economic steward).

In 2018 Jerome Powell began raising rates to blunt the sharper edges of a hot economy and return interest rates to somewhere near a historic norm. Since 2008 rates had remained at emergency low levels, and there was a genuine concern that markets were becoming addicted to cheap cash. In October of that year Jerome Powell made clear that rate hikes would continue until the Fed felt they’d reached a neutral rate, news not well received by the stock market. From October to the end of the year the S&P 500 lost 18% by December 24th, before rebounding slightly by the New Year. Markets had posted decent returns to the end of September, but wiped out those gains and finished the year -6.24% . During the last months of the year Trump made repeated efforts to pressure Powell to halt or cut rates, often publicly over Twitter.

My opinion is that Trump likes the ambiguity surrounding his pronouncements. Whether he actually intends to implement all the tariffs he’s discussed, whether they are bargaining positions, or whether he can be talked out of them is a grey area that offers him a position of strength. Politicians may be particularly vulnerable to his vagaries since they often wish to protect the status quo while Trump feels free to be a disruptor. But that grey area only works as a negotiating tactic so long as people believe that deals can be reached. If nations come to believe that Trump is serious and literal about tariffs and don’t believe they can be avoided, you are only left with a trade war. Similarly if you are in charge of the Federal Reserve and believe that Trump will do what he says, then you have every reason to pursue positions that curb inflation.

Following Trump’s election Jerome Powell was asked whether he would resign as the Federal Reserve chair, and was clear in his response; he will not, he is not required to leave, and cannot be compelled to. Trump already has a difficult and publicly hostile history with Powell, and its easy to imagine that if Powell is taking Trump seriously, he will move into direct conflict with Trump because of his policies, not in spite of them. Similarly conflict may be around the corner on diplomatic issues for the exact same reason. If Mexico feels it can’t avoid a trade fight with the US, you can assume that Mexico might be less interested in working to curb migrants at the US border. In Canada the same might be true, negotiating with someone who has no intent to make a deal (or honor the one already made) is not likely to build support for concessions.

Today Trump will take office following his inauguration, and he’s expected to sign a number of executive orders kicking off his next term. He has posed as a disruptor, and has nominated a number of other unusual thinkers and people opposed to the status quo to make up his cabinet. Whether they all take those roles and can do what they say they plan too is yet to be seen, but on December 18th we may have gotten some insight into what that future might look like, a future where Donald Trump is taken at his word, both seriously and literally.

Aligned Capital Partners Inc. (“ACPI”) is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through Walker Welath Management, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/Walker Wealth Management and covered by the CIPF. Financial planning services are provided through Walker Wealth Management. Walker Wealth Management is an independent company seperate and distinct from ACPI/Walker Wealth Management.