This piece was meant to come out last week before the most recent tariff announcement. It was delayed, but the points it makes remain relevant.

Donald Trump’s actions since taking office have failed to deliver the kind of economic and market stimulation people had been imagining. For many professionals, business owners, and financial analysts, the assumption was that Trump would be good for markets and good for the economy. His other political views, like isolationism, tariffs, and sense of personal grievance weren’t great features, but he would fundamentally be bound by market and economic performance.

That faith eroded quickly as it seemed that Trump was intent on widespread and indiscriminate tariffs, targeting first America’s closest trading partners, and then reciprocal tariffs on the European Union, Great Britain, Australia, and Taiwan. Concerns that this might damage the American economy may have bought time on when those tariffs were to be implemented (as of writing Canadian and Mexican tariffs have been deferred twice, though Steel and Aluminium tariffs have gone ahead) but April 2nd remains “liberation day” according to Trump, a day when America stops getting “ripped off”.

Trump’s administration have pivoted away from the idea that Trump will be good for the immediate economy, and that a “period of transition” is on the way. During his speech to Congress (officially not a State of the Nation) Trump also said that farmers will sell more of their food to Americans, ostensibly a populist message but one more likely grounded in further declines of American agricultural export.

Alongside Trump is Elon Musk, a man who seems possibly genuinely befuddled by the animosity his actions have garnered. Between possible nazi salutes, his outsized time on Twitter, his heading up of D.O.G.E (which he both officially and unofficially runs, for legal reasons), his direct intervention with Germany’s far right party the AFD, and the poor sales of his Tesla cars, TESLA stock has dropped considerably from its highs. Many have thought that this heralds the end of his company, and certainly would deal a blow to his personal fortune, about a third of which is in the form of TESLA stock.

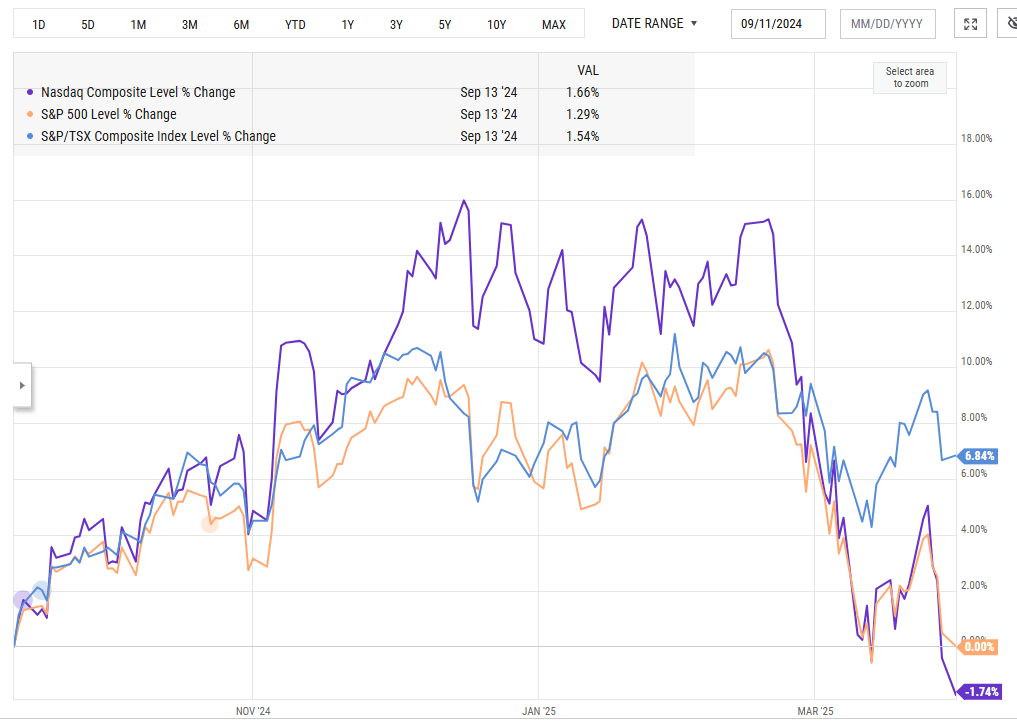

The markets peaked around February 19th, with the S&P 500 up 4.46% since January 1st. The Dow Jones had peaked a little earlier at 5.5%, and the Nasdaq Composite was up 3.86%, all respectable numbers for the first 45 days of a year, especially following a very strong 2024. Over the subsequent weeks markets began losing steam and saw a significant drop. From mid February to March 12th, a period of three weeks, the Nasdaq lost 13.05%, the S&P 500 9.31%, and the Dow 7.16%. Investors were worried, a recession seemed looming, and consumer confidence had plummeted.

Yet only two weeks later markets seemed to have stabilised. Commentators were more confident and expected Trump’s tariffs to be more “focused”. Following some fairly significant government intervention, even Tesla’s shares regained some of their lost ground, and the bond market had retreated as investor enthusiasm seemingly returned. And then, at the end of last week the enthusiasm sputtered once again.

What’s going on?

Whether you support Trump or not, his policies if fully enacted promise to reduce the size of the US economy. His expressed understanding of tariffs, how they work, what they can do, and how easily they can rewrite the global order of trade are objectively poor. Global supply chains are complicated things, and some of the most complicated aspects of them are tied up in semi-conductor manufacturing, making tariffs an expensive tax on top of essential components of the economy. His handling of international relationships has also been poor, and the seeming unravelling of the NATO alliance under his administration threatens not just global security, but also America’s defence industries, particularly the F-35 joint strike fighter, a multi-purpose fifth gen fighter whose economics only worked if it became the standard across NATO. His stated aims of building a coalition to contain China’s global ambitions run counter to his animosity towards global trade. Australia has been slapped with steel tariffs despite having a trade deficit with the United States, all while Australia now does three times as much trade with China as it does with America. Japan and South Korea are rapidly reorienting themselves towards China and seeking better relations with them for protection. The sudden rise of a hostile border force, detaining Canadian and European’s alike, seems to be shrinking the US’s tourism by up to 15%.

But these things have not yet fully come to pass. Trump’s way of engaging with government is dictatorial with a reality show slant. Rarely does he spell out what a policy will be and frequently defaults to the phrase “we’ll see what happens.” This level of uncertainty gives Trump room to maneuver, and allows the market to engage in its most common behavior; optimism. Trump may seem to be heading towards a recession, but there remains a chance he may change his mind. The market sell-off through February and March was not an indictment of Trump’s government. It was a reset on the risk for investors and an opportunity to reevaluate what might happen next. That leaves considerable latitude for Trump’s administration to back away from damaging policies, or double down on them.

Heading into 2025 it looked like the US economy was the strongest globally, and while the early days of the new administration seemed to have changed some of that math, what it means is that there is still lots of different ways that the year could still unfold. The United States may back away from its trade war, claiming victory with whatever concessions can be finagled. Elon Musk might be kicked out of the Trump inner circle, something that would certainly change the calculus about how the government would be run. Voters, which look considerably less impressed with Trump’s early policies, might be so angry that Republican members of the house find the nerve to push back on the administration. There are lots of potential futures.

For investors the challenge is to find a path that will allow them to navigate between the pessimism of Trump’s detractors and the optimism of his own administration. After so many positive years in the markets there is real wisdom in taking some of those profits off the table, and good investment policy hasn’t changed. Given the very strong performance out of the United States for the past five years, its likely that those investments have grown, especially relative to other equity positions. This is a good time to ensure that portfolios are well diversified and that assets are not too concentrated. Lastly, safety is something that should be given real thought to. Rob Carrick of the Globe and Mail wrote a piece arguing that if you need your money in the next five years, you should pull it out now. That advice should be tempered with a conversation with your actual financial advisor, but what all investors should be looking for is a blend of the following:

- Enough equities to participate in good markets across the globe.

- Enough safety that they won’t panic if markets do worse.

- Enough cash to be able to take advantage of bad markets when they come up.

These three principles will look different for everyone, but should be balanced by the amount of risk you can absorb, and the ability to continue to meet your financial goals.

As we get closer to Trump’s “liberation day”, how much of Donald Trump’s policy agenda is well understood by investors is up for debate. According to Bloomberg, as well as some other news sources, retail investors followed a “buy the dip” mentality over March, while big institutional investors backed away. The market is not settled on what is going to happen, and while its tempting to say that little investors might take the biggest losses, there have been many instances of mistakes by large institutional investors. At the same time, there are many reasons to be cautious now. Though markets are off their all-time highs, they remain still at historic levels, and while the news has been quick to discuss “market panics” and “market crashes”, in truth we’ve only gone back to where we were in September. Investors should be on guard that markets can still go in either direction.

This leads to my final point. Investors will need to show patience in the face of the uncertainty. Followed to their natural ends, as I’ve outlined, many of his most aggressive policies don’t bode well for the future. But many of these policies may simply not come to pass. Markets may surprise people expecting the worst, and our own personal feelings about Trump and his administration’s actions may cloud our judgement about reality. What investors need to be is patient, and prepared.

Aligned Capital Partners Inc. (“ACPI”) is a full-service investment dealer and a member of the Canadian Investor Protection Fund (“CIPF”) and the Canadian Investment Regulatory Organization (“CIRO”). Investment services are provided through Walker Wealth Management, an approved trade name of ACPI. Only investment-related products and services are offered through ACPI/Walker Wealth Management and covered by the CIPF. Financial planning services are provided through Walker Wealth Management. Walker Wealth Management is an independent company separate and distinct from ACPI/Walker Wealth Management.