The end of the year always brings on reviews of the biggest stories, but its probably more accurate to say that the biggest stories of any year are really the consolidation of events and ideas from many years prior. So as we look ahead, what events from the past might come to their rightful end in 2020?

Fragile Worlds and Global Challenges

News of the rapid spread of the “novel coronavirus”, the dramatic quarantining of multiple Chinese cities and the wall to wall media coverage have made the new disease an inescapable part of life. But while the ultimate severity of the virus remains unknown, the larger impact on the global economy is slowly coming into focus. An interconnected planet that is dependent on economies functioning half a world away can find itself in serious trouble when 40 – 50 million people are suddenly quarantined. Consumer spending in China has dropped off significantly, and expectations are that the government may have to take dramatic action to ultimately support the economy. However, the impact of such a large public effort will not only hurt the Chinese economy, but may hamper the already minor commitments that they have made to the US in the new “Phase 1 Treaty”, which will also hurt the US economy, one that has already showing signs of weakness over the last year. The long-term threat of the corona virus may not be its impact to our bodily health, but to financial health.

The Missing Inflation

For years economists and central bankers have been puzzled by the lack of inflation from the economy. No amount of economic growth or declining unemployment seemed to move the needle on inflation, and it remained stubbornly and frustratingly at or below the 2% target most banks wanted.

One explanation for this is that the labor participation rate has been very low and that the unemployment rate, which only captures workers still looking for work and not those that have dropped out of the workforce altogether, didn’t tell the whole story about people returning to the workforce. The result has been that there has been an abundance of potential workers and as a result there really hasn’t been the labor shortage traditionally needed to begin pushing up inflation.

One explanation for this is that the labor participation rate has been very low and that the unemployment rate, which only captures workers still looking for work and not those that have dropped out of the workforce altogether, didn’t tell the whole story about people returning to the workforce. The result has been that there has been an abundance of potential workers and as a result there really hasn’t been the labor shortage traditionally needed to begin pushing up inflation.

But there are some signs that inflation is coming back to bite. First, and interesting article from the CBC highlighted just how many vacancies there are in trucker . There is currently a shortage of 22,000 drivers, and that’s expected to climb to 34,000 in the next few years. Trucking pays well, but maybe it doesn’t pay well enough. In a universe where many Canadian university educated citizens can’t get work outside of Starbucks, how is it that people haven’t jumped at the chance to get into this lucrative practice?

Trucking isn’t the only trade lacking employees. Nursing and pilots are another two trades that are facing severe shortages. How long can some major industries resist raising wages as shortages start to pile up?

Canada’s Economic Problems

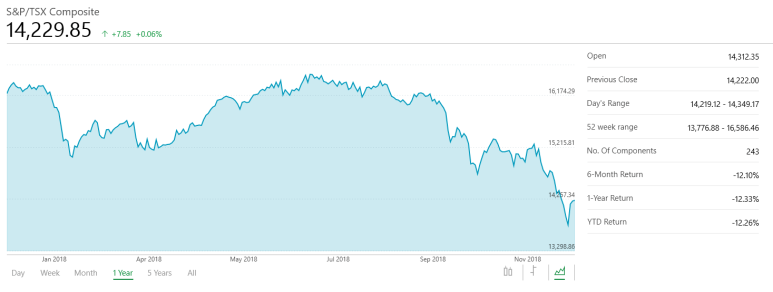

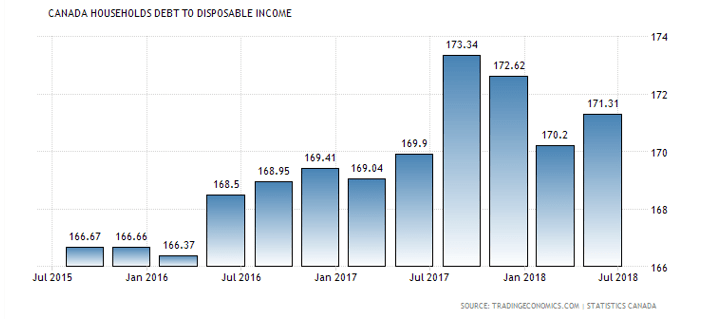

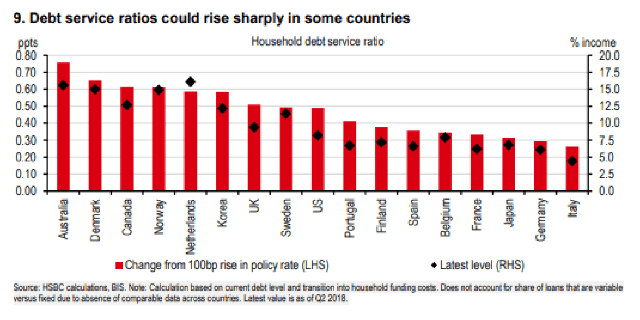

The short version of this story is that Canadians are heavily in debt and much of that debt is sensitive to interest rates. Following a few rate hikes, insolvencies started to creep up in Canada and 2020 may be a year in which the historically high personal debt rates of Canadians start to have an impact on the Canadian economy. According to the Toronto Star and CTV News Canadian insolvency rates are highest they’ve been since the financial crisis, only this time there isn’t a crisis.

The short version of this story is that Canadians are heavily in debt and much of that debt is sensitive to interest rates. Following a few rate hikes, insolvencies started to creep up in Canada and 2020 may be a year in which the historically high personal debt rates of Canadians start to have an impact on the Canadian economy. According to the Toronto Star and CTV News Canadian insolvency rates are highest they’ve been since the financial crisis, only this time there isn’t a crisis.

As I wrote before Christmas, economic situations create populist movements, and if Canadians are facing a growing economic problem, widespread and with many Canadians vulnerable we should be mindful that an economic problem may become a political one.

A Crisis in Education and Generations

Walking hand in hand is the increasing cost of education, and the declining returns it provides. In the United States the fastest growth in debt, and the highest rate of default is now found in student debt. According to Reuters the amount of unpaid student debt has doubled in the last to about $1.5 trillion. The financial burden can be seen in the age of first-time home buyers which has been creeping up over the previous decade and is now pushing 35. The primary step in building a life and the pushing of that life off explains some of the current disaffection with politics and economy that has led a growing number of younger people to hold a favorable view of Communism.

Walking hand in hand is the increasing cost of education, and the declining returns it provides. In the United States the fastest growth in debt, and the highest rate of default is now found in student debt. According to Reuters the amount of unpaid student debt has doubled in the last to about $1.5 trillion. The financial burden can be seen in the age of first-time home buyers which has been creeping up over the previous decade and is now pushing 35. The primary step in building a life and the pushing of that life off explains some of the current disaffection with politics and economy that has led a growing number of younger people to hold a favorable view of Communism.

The Recession Everyone is Waiting For

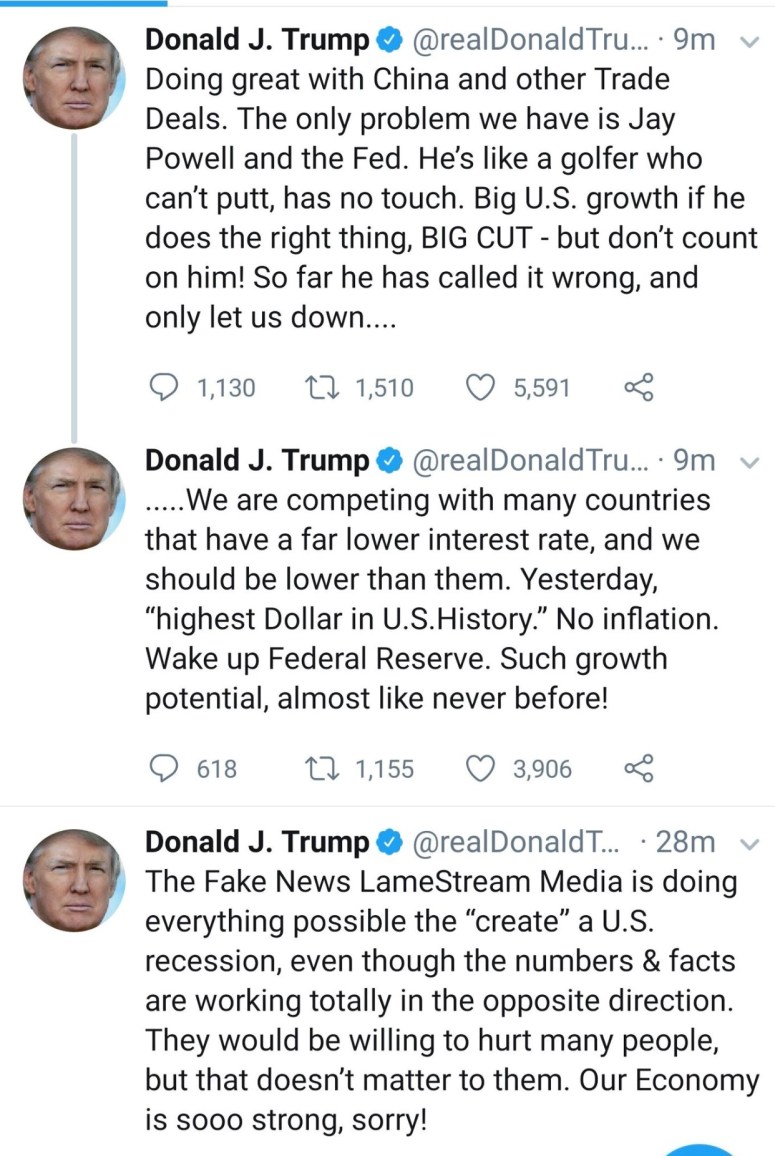

Following three years of growing trade wars, a decade of uninterrupted economic growth, and market valuations at all time highs, the expectation of a recession has reached a fever pitch. With 2020 being an election year it seems likely that Trump will try and sooth potential economic rough patches, the first of which will be with China, where his trade war is as much about getting a better deal as it is about winning political points with his followers. The first phase of the trade deal is to be signed very soon but details about that deal remain scant. It’s likely that the deal will do more for markets than the wider economy as there is little benefit for China to go for a quick deal when a protracted fight will better work to their advantage.

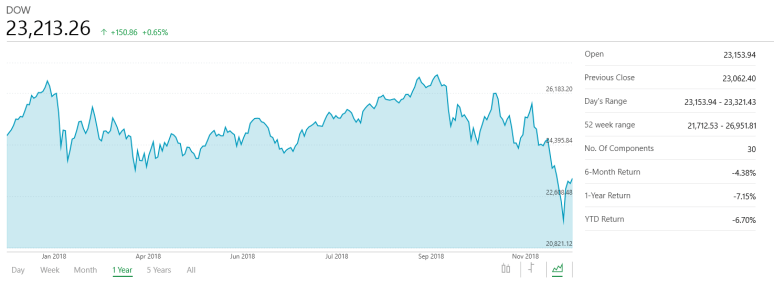

Efforts to hold off an actual recession though may have moved beyond the realm of political expediency. Globally there has been a slowdown, especially among economies that export and manufacture. But perhaps the most worrying trend is in the sector that’s done the best, which is the stock market. Compared to all the other metrics we might wish to be mindful of, there is something visceral about a chart that shows the difference in price compared to forward earnings expectations. If your forward EPS (Earnings Per Share) is expectated to moderate, or not grow very quickly, you would expect that the price of the stock should reflect that, and yet over the past few years the price of stocks has become detached from the likely earnings of the companies they reflect. Metrics can be misleading and its dangerous to read too much into a single analytical chart. However, fundamentally risk exists as the prices that people are willing to pay for a stock begin to significantly deviate from the profitability of the company.

Efforts to hold off an actual recession though may have moved beyond the realm of political expediency. Globally there has been a slowdown, especially among economies that export and manufacture. But perhaps the most worrying trend is in the sector that’s done the best, which is the stock market. Compared to all the other metrics we might wish to be mindful of, there is something visceral about a chart that shows the difference in price compared to forward earnings expectations. If your forward EPS (Earnings Per Share) is expectated to moderate, or not grow very quickly, you would expect that the price of the stock should reflect that, and yet over the past few years the price of stocks has become detached from the likely earnings of the companies they reflect. Metrics can be misleading and its dangerous to read too much into a single analytical chart. However, fundamentally risk exists as the prices that people are willing to pay for a stock begin to significantly deviate from the profitability of the company.

Market watchers have been hedging their bets, highlighting the low unemployment rate and solid consumer spending to hold up the markets and economy. But the inevitability of a recession clearly weighs on analysts’ minds, and with good reason. In addition to the growing gap between forward earnings expectations and the price people are willing to pay, we now see the largest spread between the S&P 500 Stock price Index and the S&P 500 Composite Earnings (basically more of the above) ever recorded for the S&P 500. While this tells us very little about an imminent recession, it tells us a great deal about the potential for market volatility, which is high in a market that looks expensive and overbought.

Climate Change

Climate change has garnered much attention, and while I believe that more should be done to deal with the earth’s changing biosphere, I fear that the we are having a hard time finding the most meaningful ways of doing that. In the wake of our inaction we will witness the continued economic costs of a changing environment.

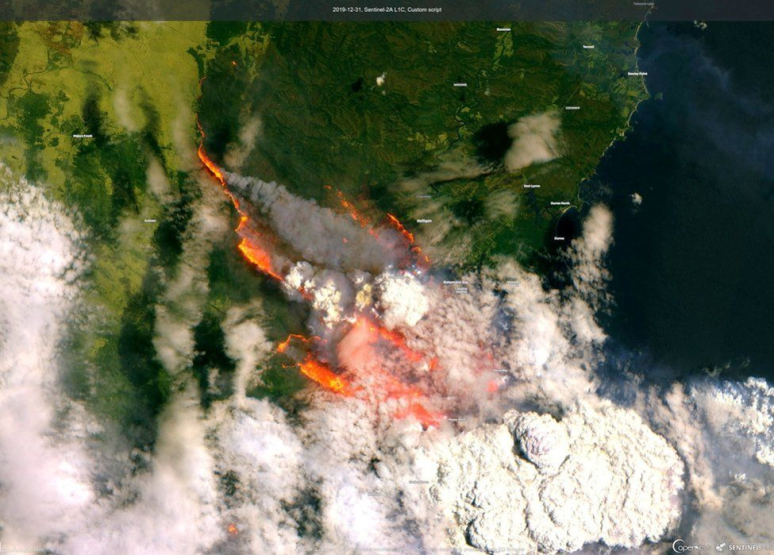

Australia, which has had years of heat waves, has recently faced some of the worst forest and brush fires imaginable (and currently bracing for more). At its peak in early January, an area of land roughly the twice the size of Belgium was burning, and an estimated billion animals had died. Some towns have been wiped out and the costs of all this will likely come somewhere into the billions once everything has been totaled. What’s important, and the bit hard to get your mind around, is that this is not A FIRE, but is a season of fires and there were more than 100 of them. And it is happening every year. It’s now a reoccurring problem in California, as well as Western Canada, and in the rainforests of Brazil. As I’ve said before, the story of climate change is about water, and the cost of that will be high.

Australia, which has had years of heat waves, has recently faced some of the worst forest and brush fires imaginable (and currently bracing for more). At its peak in early January, an area of land roughly the twice the size of Belgium was burning, and an estimated billion animals had died. Some towns have been wiped out and the costs of all this will likely come somewhere into the billions once everything has been totaled. What’s important, and the bit hard to get your mind around, is that this is not A FIRE, but is a season of fires and there were more than 100 of them. And it is happening every year. It’s now a reoccurring problem in California, as well as Western Canada, and in the rainforests of Brazil. As I’ve said before, the story of climate change is about water, and the cost of that will be high.

More of the Same

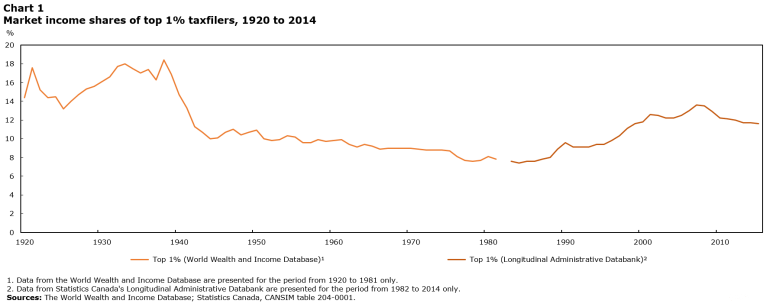

There is a lot of focus on the growing disparity between the very wealthiest and poorest in our society. This renewed interest in the level of inequality is a conversation worth having but is frequently presented in a way that isn’t helpful. For instance it’s been pointed out that the concentration of wealth at the very top of society has only continued to intensify, and a recent report from the Canadian Centre for Policy Alternatives (Published January 2nd, 2020) points out that a “top 100 CEO” saw their pay increase 61% over the last decade. However, to muddle matters, the “top 100 CEOs” remains a fairly non representative group and within Canada wealth concentration for the top 1% has been falling since 2007 (which also represented the highest concentration since 1920).

This isn’t really about wealth inequality, so much as how unhelpful it is to sling statistics back and forth at one another every day endlessly. A better way to understand what’s happening is to see where is winning rather than who is winning. In the United States, which has seen a long period of job growth, 40% of new jobs were created in just a handful of cities (20 to be precise).

Those cities, like Seattle, Portland, LA, Atlanta, Austin, Dallas, and, Miami, have all been rewarded in the 21st century, while many of the remaining 350 metropolitan areas had to share the other jobs, and many of those areas saw their share of jobs decline in the same period. An even smaller group of five cities have picked up the bulk of new innovation businesses, a key issue as traditional industries like retail and manufacturing falter, but Computer System Designers are thriving in the new economy. The issue of wealth inequality is not going to be easily dealt with by simply taxing billionaires. Inequality is a geographic story and one likely to persist into the future.

Conclusion

The stories of 2020 are likely going to hit many of the themes we’ve been touting over the last 8 years. Cities, affordability, resiliency, aging populations, environmental change and reckless speculation will remain central to news reporting. But the biggest story will likely be how well we responded to these issues…

Did I miss anything? Let me know! And as always if you have any questions, wish to review your investments or want to know how you can address these issues in your portfolios, please don’t hesitate to email me! adrian@walkerwealthmgmt.com

Information in this commentary is for informational purposes only and not meant to be personalized investment advice. The content has been prepared by Adrian Walker from sources believed to be accurate. The opinions expressed are of the author and do not necessarily represent those of ACPI.

The temptation to assume that everything is about to go wrong is therefore not the most far-fetched possibility. Investors should be cautious because there are indeed warning signs that the economy is softening and after ten years of bull market returns, corrections and recessions are inevitable.

The temptation to assume that everything is about to go wrong is therefore not the most far-fetched possibility. Investors should be cautious because there are indeed warning signs that the economy is softening and after ten years of bull market returns, corrections and recessions are inevitable.

I wish to inform you about an exciting new profession, currently accepting applicants. Accurate recession prognostication and divination is an up and coming new business that is surging in these turbulent economic times! And now is your chance to get in on the ground floor of this amazing opportunity!

I wish to inform you about an exciting new profession, currently accepting applicants. Accurate recession prognostication and divination is an up and coming new business that is surging in these turbulent economic times! And now is your chance to get in on the ground floor of this amazing opportunity!