The economic fallout of the pandemic has garnered many shocking headlines, from concerns over how many restaurants may fail to the sheer number of people seeking unemployment insurance. Some of this is economic rubber necking, basking in the shocking and outlandish statistics generated by the lockdown and pandemic. The real test is still in front of us, determining what is temporary and what is permanent.

Concern that a number of restaurants may not reopen seems a reasonable fear, since lots of restaurants don’t survive normally. The impact to the airline industry will take years to work out, since you can’t just put all those planes back in the sky. It will take time to determine which routes should be brought back first, how many people want to fly and the planes themselves will need considerable maintenance before any of them roll down a runway.

But hope springs eternal. Eight weeks into the lockdown and efforts remain underway to gradually reopen the economy, and in time we will see which parts of our society (not economy, but society) need real help to get back on its feet.

I remain largely optimistic about the speed of the recovery once it’s safe to reopen, but remain cautious regarding existing problems within the Canadian economy that the pandemic will likely accelerate. Problems that were hidden just under the surface will find themselves in the cold light of day, and those problems will have repercussions, many of which will not be easy to predict.

As I wrote back in March (Will Covid-19 Make Real Estate Sick?)

“Problems rarely exist in isolation, and a problem’s ability to fester, grow and become malignant to the health of the wider body requires an interconnected set of resources to allow its most pernicious aspects to be deferred. In Canada the problem has been long known about, a high level of personal debt that has grown unabated since we missed the worst of 2008. What has allowed this problem to become wide ranging is a banking system more than happy to continue to finance home ownership, a real estate industry convinced that real estate can not fail, and a political class that has been prepared to look the other way on multiple issues including short term rental accommodation, in favour of rising property values to offset stagnant wages”

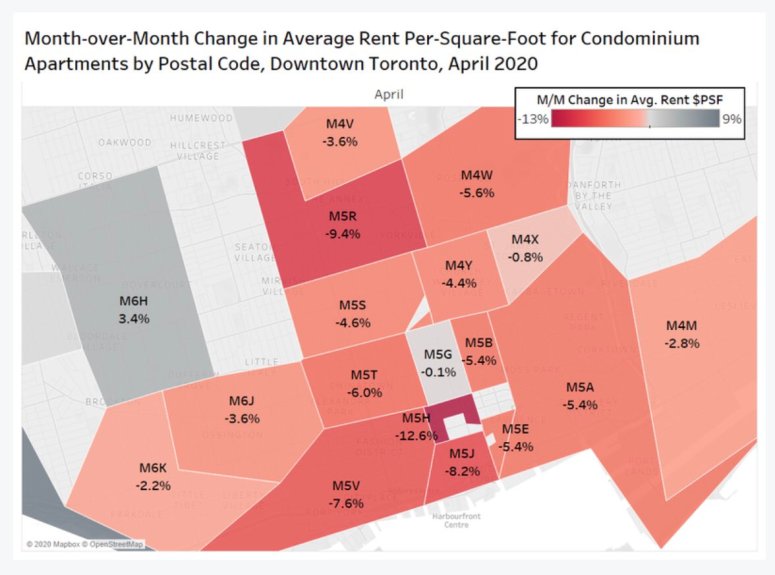

The issue of debt, real estate and short-term accommodations may be one issue undergoing a seismic shift in real time. The website MLS paints a surprisingly changed picture of the rental situation in downtown Toronto. Condominiums like the Ice Condos, located at the bottom of York Street were written about last year because so many of the units were being used for Airbnb. Today they offer hundreds of long-term rentals. The story is not limited to a few buildings either, much of the downtown condo scene, once reserved for Airbnb customers, has suddenly opened to long term accommodation.

For a city that only a few months ago was running perpetually short of rentals this change has been rapid, but its fair to assume that many of these landlords are hoping that the crisis will pass and that things will return to normal, with lucrative business in short term rentals resuming. The effect of all these new rentals is not happening in a vacuum. According to Rentals.ca in their May 2020 report, the price of condo rentals in locations like the Ice Condos have dropped by 10%.

The flip side of the real time change has been the sudden collapse in real estate sales. Reportedly year over year housing sales have dropped in Toronto by 67%, and new listing are down 64%. The selling and buying of houses has simply come to a grinding halt, and with it much of the city’s revenue from the land transfer tax, creating a secondary crisis within cities that have depended on the land transfer tax for revenue growth. In a cruel twist on a well-intentioned effort to get government finances under control, Toronto isn’t allowed to run a deficit, a constraint that has turned into a fatal weakness under the pandemic.

It is here that we should stop and consider a reality. In a few short weeks two major sectors of the Canadian economy within the city of Toronto (and Vancouver for that matter) have been radically altered. But this is also a period where we have seen the most government support and extensive economic intervention. Long term expectations have yet to shift. Airbnb hosts wish to remain Airbnb hosts. Homeowners hope to continue to use their houses to expand their financial footprint. But we should take a page from the city of Toronto reviewing its financial books, the real crisis has yet to truly unfold.

Our future contains, but has yet to have pass, the retreat of government financial support. It has yet to put people back to work, yet to reopen universities, yet to ramp up our manufacturing base, yet to know much of anything about moving past Covid-19. Clarity about what governments should or should not do are hindered by China’s resistance to openness and transparency, while other nations that have already faced the pandemic and seemed to recover are running into second waves. There is no clarity about the future.

Real estate remains at the heart of the Canadian economic story for the last 20 years. Appreciating housing prices are the chief source for growth in Canadian families’ net worth. Borrowing to buy houses and borrowing against home equity remain our chief sources of debt. Our politics revolves around the tension of needing more housing in certain highly desirable areas while preserving those areas from over development. That dynamic has revolved around a status quo that seemed to have no conceivable end. The pandemic may have radically altered the Canadian real estate landscape regardless of how people feel about it or what they want. Whether we can walk back changes of this magnitude remains very much unknowable. For now we can only watch the changes our society and economy are undergoing and hope that what we are witnessing will be for the best, those changes that have happened, and those yet to come.

Real estate remains at the heart of the Canadian economic story for the last 20 years. Appreciating housing prices are the chief source for growth in Canadian families’ net worth. Borrowing to buy houses and borrowing against home equity remain our chief sources of debt. Our politics revolves around the tension of needing more housing in certain highly desirable areas while preserving those areas from over development. That dynamic has revolved around a status quo that seemed to have no conceivable end. The pandemic may have radically altered the Canadian real estate landscape regardless of how people feel about it or what they want. Whether we can walk back changes of this magnitude remains very much unknowable. For now we can only watch the changes our society and economy are undergoing and hope that what we are witnessing will be for the best, those changes that have happened, and those yet to come.

Information in this commentary is for informational purposes only and not meant to be personalized investment advice. The content has been prepared by Adrian Walker from sources believed to be accurate. The opinions expressed are of the author and do not necessarily represent those of ACPI.