I have been previously quite critical of the excitement around IPOs and Social Media. My major complaint is that most social media doesn’t make any money, but receive incredible valuations under the assumption that they might make money someday.

I have been previously quite critical of the excitement around IPOs and Social Media. My major complaint is that most social media doesn’t make any money, but receive incredible valuations under the assumption that they might make money someday.

The reason for this is that two companies have made money this way, notably Facebook and Google. Both started out as free services with no revenue and have ballooned into mega-businesses busy shoving marketing at you everywhere you turn. This has, in turn, created a market of investors willing to buy into companies that seem to be doing big business for free on the hope that they can eventually turn a profit.

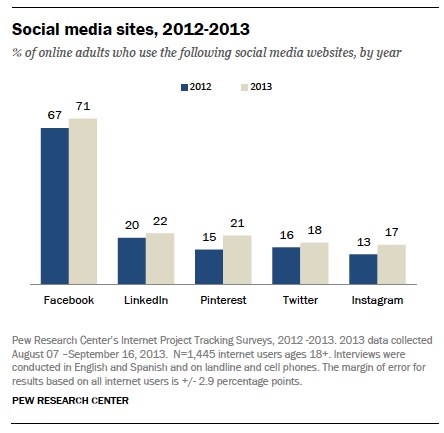

I’m critical here for a couple of reasons. First, there is little guarantee that any of these businesses can actually ever turn a profit. Social media has often been fickle, Myspace was going to be the next big thing until it was ultimately eclipsed by Facebook. And for every “Facebook” there are literally hundreds of other challengers vying for that attention. But how many Facebooks do we need? According to Pew research, not many.

Second, how success is judged should be given more scrutiny. Twitter, Facebook and other similar sites get paid by content creators to promote their material. This form of direct marketing (promoting to presumably interested parties) has really to do more with engagement than merely being seen. It’s the idea of engagement that makes these businesses viable platforms. But companies and their marketers have found making something go “viral” notoriously difficult. For every great viral video that turns out to be an ad, almost all the others fail. Estimates range from a 15% success rate, to even less.

Into this fray comes Veritasium, an entertaining science based web series that had an actual look at how Facebook might not be that useful a company to do business with. I’ll let you watch the video without spoiling his point, but I think that if you were looking for a place to spend money and understood how Facebook actually utilized your advertising dollars, you’d think twice.