Today could be a big day. Today the Federal Reserve might finally raise interest rates.

If it does it will be the first time it has done so since 2006. Interest rates, which are precisely nobody’s preferred choice of water cooler conversation, are now the subject of such intense focus it’s hard to know whether we are making too big a deal of them, or not enough of a big deal.

To review, interest rates are used to either stimulate spending or increase savings. If rates are low, we argue that borrowing is cheap and it makes sense to spend money. If rates are high and it costs more to borrow, then people and businesses are likely to save. By this process we can increase or decrease the “cost” of money. Interest rates are therefore considered important in moderating an economy. If the economy is overheating and inflation is rising, raising interest rates should put a damper on it. If the economy is worsening or in recession, lowering rates could inspire companies to spend rather than save and encourage large purchases.

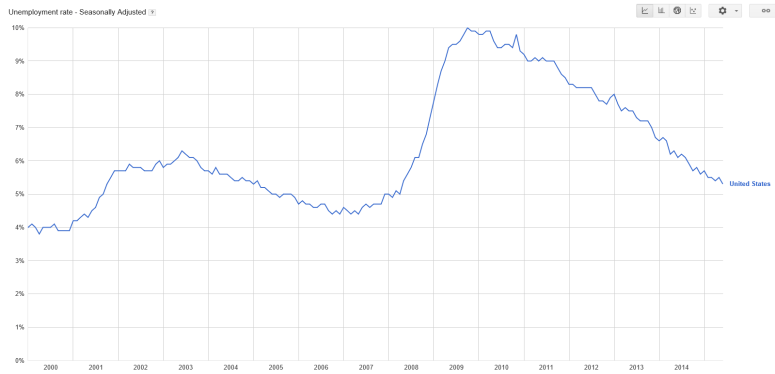

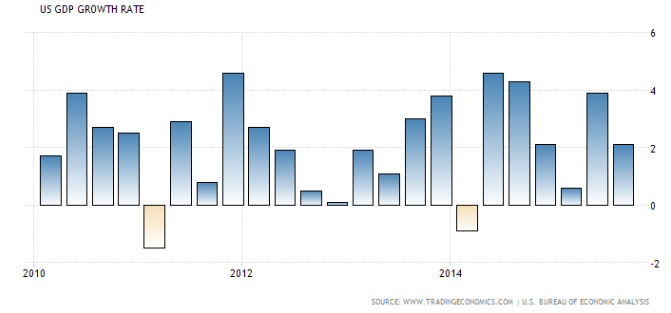

During 2008, in addition to bailouts and massive stimulus packages to the economy, the Federal Reserve in the United States heavily relied on the key interest rates to help stem the problems of the housing and banking crisis. Interest rates went from 5.25% in 2006 to 0.25% in 2008. And they’ve stayed there ever since.

Officially the rate hasn’t moved up, although the Fed has “tightened” credit to the market. Slowing down its bond buying program and ending QE has helped nudge up long term borrowing costs. But eight years on the official interest rate is still near zero, effectively emergency levels, and the economy is (supposedly) vastly improved. So why hasn’t it moved before?

There is no simple answer to that question. Markets have been nervous, inflation expectations haven’t been met, the USD has risen too fast, unemployment has been too high, the global economy too weak; all of these reasons and more.

But in the background has been a looming fear. That interest rates can’t stay at zero forever. That borrowing can’t be cheap forever. That if the market tumbles again we will have little room to maneuver. That eventually we will have to face significant inflation (and therefore significant interest rates). Those fears seem to have finally won over the largely dove-ish Federal Reserve.

But I want to posit a different thought with our readers. That maybe rates don’t matter as much as we like. Economies are large and complicated things. We only measure what we think is important and traditionally we’ve had to go back and reassess what makes economies work, especially in the face of serious recessions. Where once the Gold Standard was thought to underpin a strong economy, not a single country today relies on it. Where economies were thought to need to correct and businesses fail to right a recession, today we encourage large government spending. Where as we once thought that interest rates shouldn’t be factored into recessions, they are now our first line of defence.

Across the world interest rates are at historic lows to stimulate spending. The BoC recently suggested that interest rates could go negative, a startling and worrying sign for the Canadian economy, especially after two rate cuts this year. But behind this there must be some recognition that the use of interest rates to spur on an economy is at best logarithmic. Like slamming your foot on the gas pedal of a car the most power is delivered early on, not as the pedal reaches the floor.

And so it can be said that perhaps interest rates, currently at all time lows maybe don’t matter that much at all. Maybe you can’t trick people into spending money. Maybe there are limits to what we can do to help an economy. Maybe we have yet to truly identify what ails our economies.

I am of the opinion (in case you haven’t noticed) that the rise of big data may not foretell a future where we can know everything. Far from it, the abundance of data is at best showing that there is still much we don’t know. If the Fed hikes rates today, moving the rates up by 1/4 of a percent, I doubt that there will be any significant change to the economy. It will take years before we approach anything close to “normal” rates at around 2% or higher. In short, a rising rate today will likely mean more symbolically than it does tangibly to the economy.