In conversations the number one concern I’m asked to address is the effect of Donald Trump on markets. This isn’t surprising. He looms over everything. He dominates news cycles. His tweets can move markets. He is omnipresent in our lives, and yet curiously much of what he has done has left no lasting impression. His tweets about trade and tariffs cause short term market blips, but after a time, things normalize. In all the ways that Donald Trump seems to be in our face, his impact is felt there the least.

Trump’s real, and more concerning impact is in the slow grind he directs at public institutions that are meant to be independent and non-partisan. He’s placed people in charge of departments whose chief qualification is their loyalty to Trump, some of them no nothings and buffoons, others with disastrous conflicts of interest, with only a passing understanding of the enormous responsibility they’ve taken on. But where Trump hasn’t been able to overcome the independence of an institution, he wages tireless and relentless war against their heads. I’m talking about Trump’s yearlong obsession with the Federal Reserve and his desire for a rate cut.

The Fed, you may recall, is America’s central bank. It sets the key interest rate and uses it to constrain or ease monetary supply, the goal of which is to rein in inflation or stimulate it depending on the economic health of the nation (and world, it turns out). The Fed meets regularly and sends signals to the market whether it thinks it needs to raise or lower rates, and markets respond in kind. If the markets and federal reserve are on the same page, markets may respond positively to what is said. If markets and the fed disagree, well…

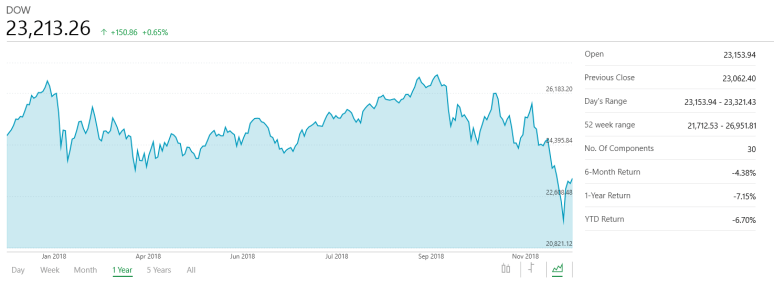

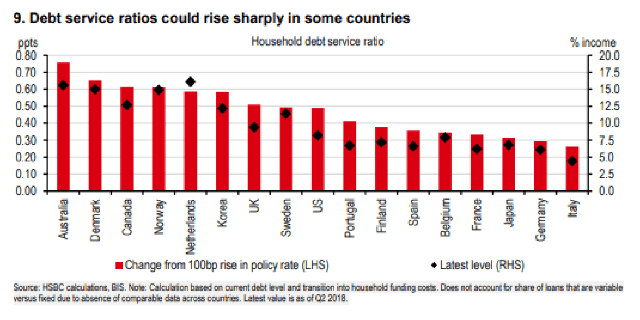

Last year the Fed was expected to raise rates to stave off inflation and hopefully begin normalizing interest rates to pre-2008 levels. Rates have been very low for the better part of a decade and with inflation starting to show itself through wages and a tightening of the labor market, the Federal reserve Chairman, Jerome Powell, was expected to make up to 4 rate hikes in 2018, which would add (about) 1% to borrowing costs. But then things started to get a bit “wibbly wobbly”.

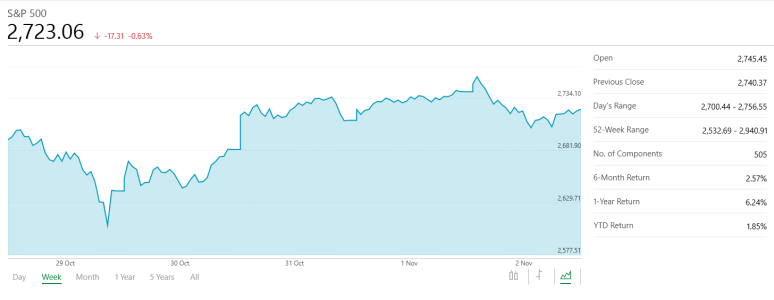

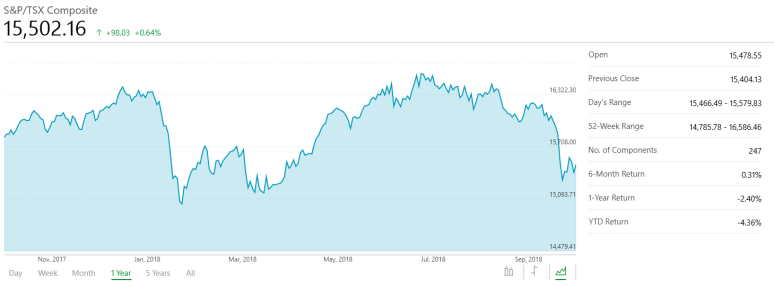

By the fourth quarter the overnight lending rate was between 2.25% and 2.5% following a rate hike in late December. That triggered a massive sell-off following a year of already disappointing market returns. The Fed was seen to be to hawkish, and the market didn’t believe the economy was strong enough to support the higher lending rate. By January the Fed had relented, saying that it the case for higher rates was no longer as strong and that its outlook would be tempered. By March the consensus view was that there would be no rate hikes in 2019 at all.

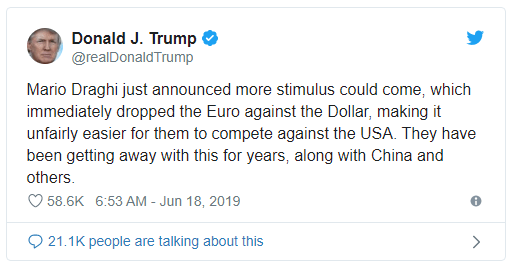

By April things had turned around. US economic data, while mixed, was generally strong. Unemployment remained historically low, and wage inflation was positive. And then Trump said this:

May was an interesting month in politics and markets. After four months of a resurgent bull market the breaks were put on in May following renewed concerns about the US and China and a trade war. By the end of May Trump was tweeting about using tariffs against Mexico to get results at the border. At this point markets had started to get nervous. The Dow Jones had shed about 2000 points, and the rumblings from Wall Street were getting pretty loud. Trump, who sees his popularity reflected in the value of the stock market, started to make noises that things were once again progressing with China and the tariff threat against Mexico was quickly put to bed. As is now typical in 2019, markets were assuaged by further tweets from the president, assuring that solutions had been found or that negotiations would begin again.

June saw a resumption of the bull run, with May’s dip largely being erased. But Trump still wanted his rate cut and increasingly so does the market. Where markets were satisfied by the promise of no new hikes earlier in the year, by June pressure was building to see an actual cut. This quarter markets have remained extremely sensitive to any news that might prompt looser monetary policy and have jumped every time its hinted that it might happen. On June 7th a weak jobs report got the market excited since it gave weight to the need for a rate cut. This past week the Fed has now signaled it may indeed cut rates as soon as this summer.

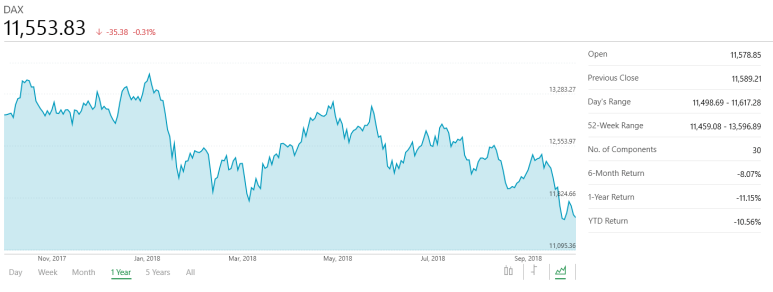

There are, of course, real concerns about the global economy. The IMF believes that if the various trade fights continue on unabated a full 0.5% of global growth could be wiped out (roughly ½ trillion dollars). That’s already on top of signs of slowing growth from Europe and Asia and at a time when markets are at all time highs when it comes to valuations. Trump is effectively saying that markets should be allowed to creep higher on the backs of cheap credit rather than on the back of real economic growth. It’s a bit like saying that you could be so much richer if you could easily borrow more money from the bank.

People with longer memories may recall that Trump, during the 2016 election campaign, had argued against the low rates of the Fed, and believed they should be much higher. Today its quite the opposite. But Trump’s chief issue is that his own pick for the Fed has continued to exert a significant amount of independence. Trump’s response, beyond merely bullying Jerome Powell over twitter has been to try and appoint more dovish members to the Fed, including a woman who used to advocate a return to the gold standard, but is now an avowed Trump supporter and of easier money.

“Any increase at all will be a very, very small increase because they want to keep the market up so Obama goes out and let the new guy … raise interest rates … and watch what happens in the stock market.”

-

Donald Trump

As with all things Trump, there is always some normal rational behind the terrible ideas being pursued. Trump’s tariffs, arguably a poorly executed attempt to punish China, is hurting US farmers and is a tax on the US citizenry. Its also done nothing to change the trade deficit, which is the highest its ever been. But nobody is under the illusion that China is a fair operator in global trade that respects IP or doesn’t manipulate currency.

There is also a very secular case to be made for a rate cut. Global markets are weakening and that traditionally does call for an easing of monetary policy, and globally many central banks have reversed course on hiking rates, returning to lower rates. For the United States there is a legitimate case that a rate cut serves as a defense if the trade fight with China draws on, and can be reversed if it is brought to a speedy conclusion.

Those points run defense for Trump’s politicization of a critical institution within the economy, and we shouldn’t forget that. Underlying whatever argument is made for cutting rates is Trump’s own goals of seeing the stock market higher for political gain, regardless of the long term impact to the health of the economy. We should be doubly worried about a politics that has abandoned its critical eye when it comes to cheap money and Wall Street greed. Individually Wall Street insiders may think that too much cheap money is a bad thing, but in aggregate they act like a drunk that’s been left in charge of the wine cellar.

Lastly, we should remember that after Trump is gone, his damage may be more permanent than we would like. Structural damage to institutions does not recover on its own, but takes a concerted effort to undo. Does the current political landscape look like one that will find the bipartisan fortitude post-Trump to rectify this damage? I’d argue not.

All this leaves investors with some important questions. How should they approach bull markets when you know that it may be increasingly be built on sand? What is the likely long term impact of a less independent Federal reserve, and what impact does it have on global markets as well? Finally, how much money should you be risking to meet your retirement goals? They are important questions the answers should be reflected in your portfolio.

The next Federal Reserve meeting is on July 30th, where the expectation is that a 25bps rate cut will be announced.

As always, call or send a note if you’d like to discuss your investments or have questions about this article.

I wish to inform you about an exciting new profession, currently accepting applicants. Accurate recession prognostication and divination is an up and coming new business that is surging in these turbulent economic times! And now is your chance to get in on the ground floor of this amazing opportunity!

I wish to inform you about an exciting new profession, currently accepting applicants. Accurate recession prognostication and divination is an up and coming new business that is surging in these turbulent economic times! And now is your chance to get in on the ground floor of this amazing opportunity!

To say that Canadians aren’t financially literate may seem a touch unfair, but everywhere you look we find testaments to this unavoidable fact. Credit cards, car loans, mortgage rates and even how returns are calculated are a confusing mess for most people. The math that governs these relationships is often opaque and can feel misleading, and its complexity assures that even if some do understand it, the details will only be retained by a tiny minority.

To say that Canadians aren’t financially literate may seem a touch unfair, but everywhere you look we find testaments to this unavoidable fact. Credit cards, car loans, mortgage rates and even how returns are calculated are a confusing mess for most people. The math that governs these relationships is often opaque and can feel misleading, and its complexity assures that even if some do understand it, the details will only be retained by a tiny minority.

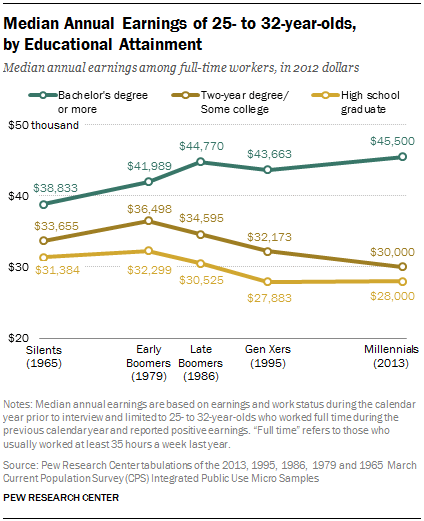

Armed with that info you might feel like the whole project makes sense. In reality, there are lots of questions about inflation that should concern every Canadian. Consider the associated chart from the American Enterprise Institute. Between 1996 – 2016 prices on things like TVs, Cellphones and household furniture all dropped in price. By comparison education, childcare, food, and housing all rose in price. In the case of education, the price was dramatic.

Armed with that info you might feel like the whole project makes sense. In reality, there are lots of questions about inflation that should concern every Canadian. Consider the associated chart from the American Enterprise Institute. Between 1996 – 2016 prices on things like TVs, Cellphones and household furniture all dropped in price. By comparison education, childcare, food, and housing all rose in price. In the case of education, the price was dramatic.

In Ontario the price of food is more expensive, gas is more expensive and houses (and now rents) are also fantastically more expensive. To say that inflation has been low is to miss a larger point about the direction of prices that matter in our daily lives. The essentials have gotten a lot more expensive. TVs, refrigerators and vacuum cleaners are all cheaper. This represents a misalignment between how the economy functions and how we live.

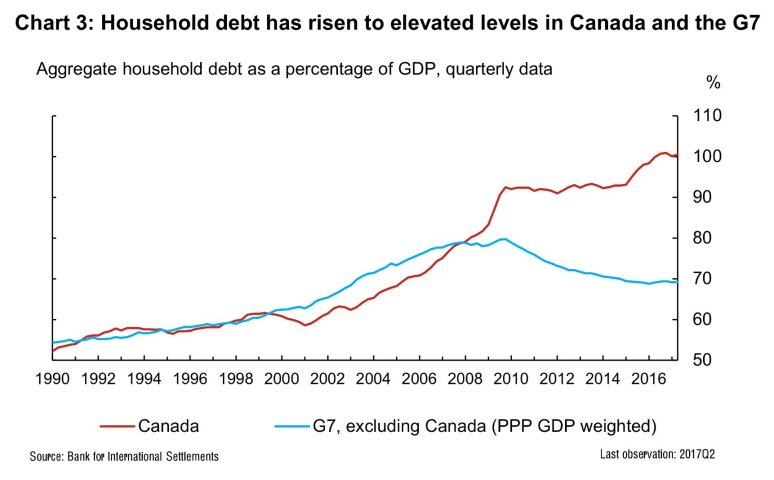

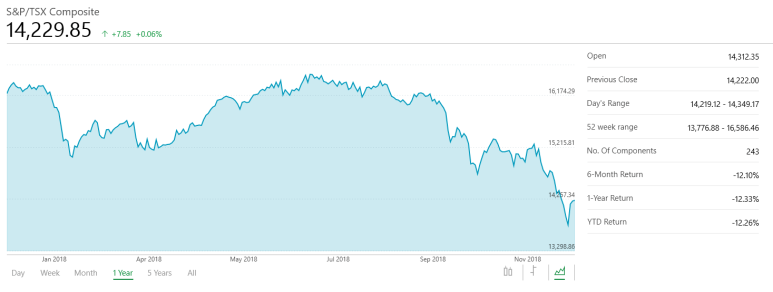

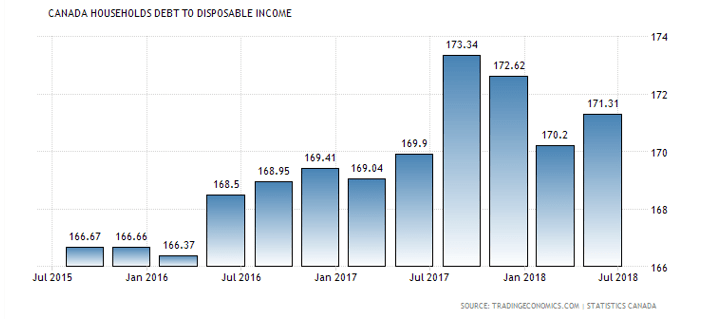

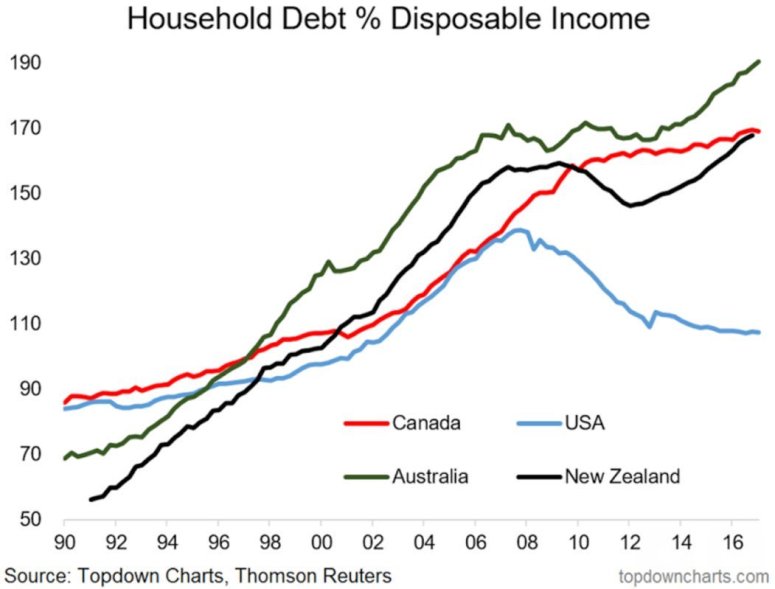

In Ontario the price of food is more expensive, gas is more expensive and houses (and now rents) are also fantastically more expensive. To say that inflation has been low is to miss a larger point about the direction of prices that matter in our daily lives. The essentials have gotten a lot more expensive. TVs, refrigerators and vacuum cleaners are all cheaper. This represents a misalignment between how the economy functions and how we live.  Economic data should be meaningful if it is to be counted as useful. A survey done by BMO Global Asset Management found that more and more Canadians were dipping into their RRSPs. The number one reason was for home buying at 27%, but 64% of respondents had used their RRSPs to pay for emergencies, for living expenses or to pay off debt. These numbers dovetail nicely with the growth in household debt, primarily revolving around mortgages and HELOCs, that make Canadians some of the most indebted people on the planet.

Economic data should be meaningful if it is to be counted as useful. A survey done by BMO Global Asset Management found that more and more Canadians were dipping into their RRSPs. The number one reason was for home buying at 27%, but 64% of respondents had used their RRSPs to pay for emergencies, for living expenses or to pay off debt. These numbers dovetail nicely with the growth in household debt, primarily revolving around mortgages and HELOCs, that make Canadians some of the most indebted people on the planet.