Last Friday I watched the TSX start to take a precipitous fall. The one stock market that seemed immune to any bad news and had easily outperformed almost every other index this year had suddenly shed 200 points in a day.

Last Friday I watched the TSX start to take a precipitous fall. The one stock market that seemed immune to any bad news and had easily outperformed almost every other index this year had suddenly shed 200 points in a day.

Big sell-offs are common in investing. They happen periodically and can be triggered by anything, or nothing. A large company can release some disappointing news and it makes investors nervous about similar companies that they hold, and suddenly we have a cascade effect as “tourist” investors begin fleeing their investments in droves.

This past week has seen a broad sell-off across all sectors of the market in Canada, with Financials (Read: Banks), Materials (Read: Mining) and Energy (Read: Oil) all down several percentage points. In the course of 5 days the TSX lost 5% of its YTD growth. That’s considerable movement, but if you were looking to find out why the TSX had dropped so much so quickly you would be hard pressed to find any useful information. What had changed about the Canadian banks that RBC (RY) was down 2% in September? Or that TD Bank (TD) was down nearly 5% in a month? Oil and gas were similarly effected, many energy stocks and pipeline providers found themselves looking at steep drops over the last month. Enbridge (ENB) saw significant losses in their stock value, as did other energy companies, big and small, like Crew Energy (CR).

All this begs the question, what changed? The answer is nothing. Markets can be distorted by momentum investors looking to pile on to the next hot stock or industry, and we can quibble about whether or not we think the TSX is over valued by some measure. But if you were looking for some specific reason that would suggest that there was something fundamentally flawed about these companies you aren’t going to have any luck finding it. Sometimes markets are down because investors are nervous, and that’s all there is to it.

Market panic can be good for investors if you stick to a strong investment discipline, namely keeping your wits about you. Down markets means buying opportunities and only temporary losses. It help separates the real investors from the tourists, and can be a useful reminder about market risk.

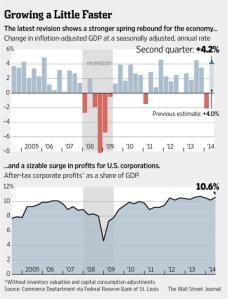

So was last Friday the start of a big correction for Canada? My gut says no. The global recovery, while slow and subject to international turmoil, is real. Markets are going to continue to recover, and we’ve yet to see a big expansion in the economy as companies deploy the enormous cash reserves they have been hoarding since 2009. In addition, the general trend in financial news in the United States is still very positive, and much of that news has yet to be reflected in the market. There have even been tentative signs of easing tensions between Russia and the Ukraine, which bodes well for Europe. In fact, as I write this the TSX is up just over 100 points, and while that may not mean a return to its previous highs for the year I wouldn’t be surprised if we see substantial recoveries from the high quality companies whose growth is dependent on global markets.