Back in the spring, markets reeled after Trump announced a new round of unilateral tariffs. The April 2nd announcement triggered a week of panic selling until the administration promised a temporary 90-day pause to pursue trade negotiations. Nine months later, the U.S. now has the highest tariff levels in over a century, economic data is showing signs of weakening, and discussions of a market bubble are widespread. Why, then, is the stock market still so high?

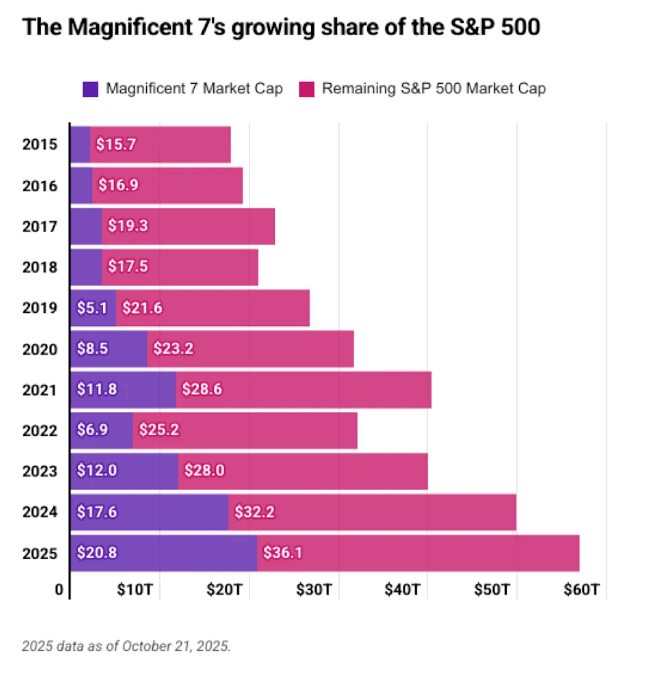

The most immediate reason is the concentration of market leadership. The “Magnificent Seven” tech giants now account for more than 35% of the S&P 500, while the top ten companies make up nearly 40%. The gap between the S&P 500 and its equal-weighted equivalent is just shy of 10%, while the Magnificent Seven themselves have delivered a combined return of roughly 27.6% year-to-date. The comparison to the dot-com era is easy to make, but the fundamental difference is profitability: Apple, Google, Microsoft, Amazon, Meta and others continue to generate substantial earnings and hold enormous balance-sheet reserves. This profitability has helped anchor market confidence.

Another factor is the lag in how economic data reflects policy changes. Despite the risks tariffs pose, the full impact has not yet shown up in backward-looking data like GDP or employment reports. Investors expecting an immediate shock instead found resilient quarterly numbers, reinforcing confidence rather than shaking it.

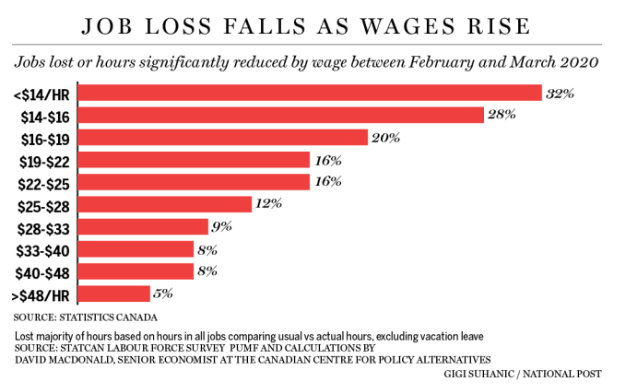

There is also a deeper structural issue: the increasing concentration of economic power and spending. As wealth inequality widens, a large share of U.S. households are contributing less to measured economic activity. Recent consumer expenditure data suggests that the top 10% of households now account for roughly 50% of all consumer spending, while the bottom 60% contribute less than 20%. This means that economic stress among the majority of households may not meaningfully register in the headline data that markets rely on. Meanwhile, AI-related capital investment makes up a growing share of the remainder of measured economic activity.

This combination — delayed data effects, high concentration of consumption, and sustained AI investment — has helped keep investor sentiment resilient, even as negative signals accumulate beneath the surface. It has also masked the risks of allowing speculative dynamics to develop largely unchecked.

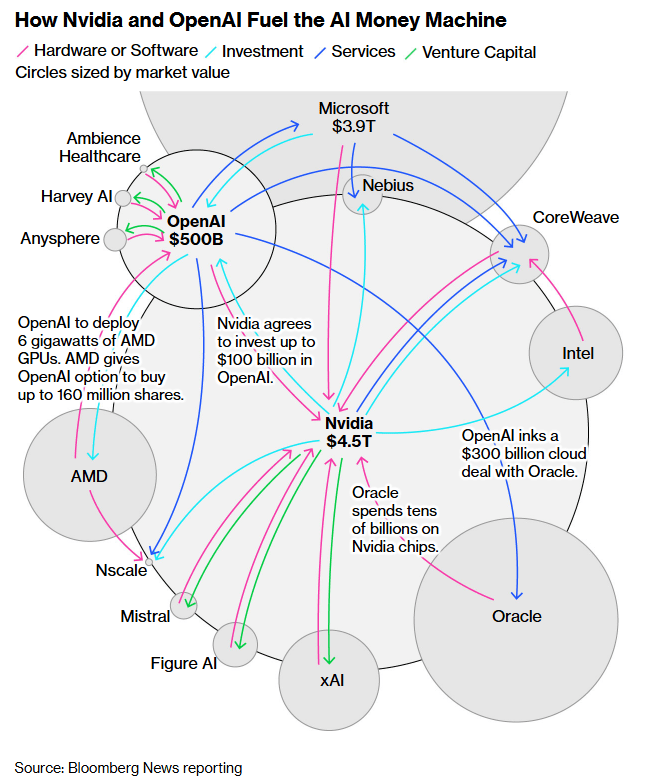

Concerns about an AI bubble are growing. Estimates of total AI investment now exceed $3 trillion when considering capital expenditures, valuations, and related infrastructure spending. Commercial use cases outside of a few sectors remain limited. Some firms have begun participating in “circular funding arrangements,” where they invest in each other’s AI initiatives to reinforce perceived valuations. Even industry leaders acknowledge the speculative environment: Sam Altman, the CEO of Open AI has said there is likely a bubble, while Jeff Bezos has called this a “good bubble” that will still produce transformative breakthroughs.

History suggests that speculative cycles are remarkably resistant to logic. They often convert skeptics into participants, including professional money managers who join in under client pressure. Market bubbles resemble the proverbial frog in a pot: the danger rises slowly enough to dull caution.

Yet they also resemble the “watched pot” that never seems to boil. As long as new capital continues to flow into AI-linked investments, momentum can persist. Predicting the end of a bubble is famously difficult — markets can remain irrational longer than investors can remain solvent.

So what should investors do? Awareness of rising risk is the starting point. We may not be able to time the end of the AI boom, but we can examine investor behavior for signs of speculative excess.

Consider Tesla. After the election, the stock surged nearly 98% in six weeks on enthusiasm linked to political alignment and narrative momentum. Since then, sales have weakened, profitability has declined, and competition has intensified — yet the stock remains 10% above its level on inauguration day and has more than doubled off its lows. Tesla’s valuation continues to reflect belief in future breakthroughs rather than current operational performance. It is a clear illustration of narrative overpowering fundamentals — a hallmark of speculative markets.

If this environment feels uncomfortable, it may be time to review portfolio risk exposure. Reducing equity risk comes with trade-offs — especially missing out on momentum-driven gains — but clarity on long-term goals can help prevent emotionally driven decision making.

Market manias are difficult to avoid and even harder to detach from when others are benefiting. The antidote is a disciplined investment plan that emphasizes long-term objectives over short-term excitement. In a world where the water may be warming around us, it is better to be a watcher than the frog.

But what of the predictions we keep hearing about? That life will be forever changed by the events we’re living through? While I have a great deal more to say about the nature of prognostication, I’ll keep my comments here brief. In general history shows that humans don’t tend towards radical changes following big, but temporary upheavals. Instead, crises like the one we are living through emphasize existing weaknesses within the society.

But what of the predictions we keep hearing about? That life will be forever changed by the events we’re living through? While I have a great deal more to say about the nature of prognostication, I’ll keep my comments here brief. In general history shows that humans don’t tend towards radical changes following big, but temporary upheavals. Instead, crises like the one we are living through emphasize existing weaknesses within the society.

As proof that the robot revolution will spare no one, even our industry is feeling the intense weight of cheap human alternatives in the form of “robo-advisors”. Given some glowing press by the Globe and Mail over the last weekend, robot advisors now represent a real and growing segment of the financial services markets and are forcing many advisors, including us, to ask how they and we will live together and what our respective roles will be.

As proof that the robot revolution will spare no one, even our industry is feeling the intense weight of cheap human alternatives in the form of “robo-advisors”. Given some glowing press by the Globe and Mail over the last weekend, robot advisors now represent a real and growing segment of the financial services markets and are forcing many advisors, including us, to ask how they and we will live together and what our respective roles will be. To say that robo-advisors are a hot topic among financial advisers is to understate the collective paranoia of an industry that has come to see itself as besieged with critical and often unfair press. We haven’t been to a conference, meeting or industry event that doesn’t at some point involve financial advisors attempting to rationalize away the looming presence of cheap and impersonal financial advice. While there are some good questions that get asked at these events, there is a whiff of denial that must have given false hope to autoworkers in the 80s and 90s in these conversations.

To say that robo-advisors are a hot topic among financial advisers is to understate the collective paranoia of an industry that has come to see itself as besieged with critical and often unfair press. We haven’t been to a conference, meeting or industry event that doesn’t at some point involve financial advisors attempting to rationalize away the looming presence of cheap and impersonal financial advice. While there are some good questions that get asked at these events, there is a whiff of denial that must have given false hope to autoworkers in the 80s and 90s in these conversations.