Last week it looked as though Russia was escalating its engagement in Ukraine, sending supplies directly into Ukrainian territory and potentially starting a full blown war. But things have remained opaque since then, with increasing reports that Russian troops were crossing the border and Russia steadfastly denying it. But after days of reports from the Ukraine that Russia had started a low level invasion to assist with Pro-Russian forces, CNN reports this morning that Russia is now using tanks and armoured personal carriers and is fighting on two fronts within the Ukraine.

Whether this proves to be a false start, or if Russia is going to become more open in its military involvement it’s hard to say. What is clear is that this war in Ukraine is far from over.

Meanwhile this week also saw some evidence about the rising cost of food in Russia as a result of the retaliatory trade restrictions directed at nations like the United States, Canada and most of Europe. Reported in Slate and Vox.com, this graph of rising food costs is actually quite surprising. Potato prices have risen by 73%!

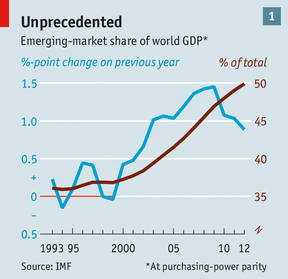

I’m reluctant to say too much about this situation and what it means from an investor standpoint, lest people think I am taking the suffering of people in a war zone too lightly. I will say that as emerging market countries become richer and begin to flex their national muscles, jostling over everything from important natural resources, long disputed borders, and sometimes even national approval, its likely that international events could increasingly be outside of our control. Since much of our manufacturing is now outside of our borders, and often even energy supplies come from nations openly hostile to us, we find ourselves in an economic trap of our own making. How can you act with a free hand against a nation that holds so many of your own economic interests?

I sincerely doubt that our sanctions against Russia or high potato prices will bring Putin to his knees, (although his people may get fed up with higher food costs) but in the past it was much clearer how to deal with this kind of brinkmanship. Today we live a world where many of our economic interests are heavily tangled with nations who do not share our same strategic goals. It is said that nations do not have friends, only interests, and as Emerging Markets look increasingly attractive to foreign investors we may have to remind ourselves that Emerging Markets are not simply opportunities for growth, but nations with their own set of interests and goals separate from our own.