You would probably make a terrible stock picker. You really would. Why you ask? Because the world is big and complicated and its hard to hold on to more than a small piece of it at any one time.

You would probably make a terrible stock picker. You really would. Why you ask? Because the world is big and complicated and its hard to hold on to more than a small piece of it at any one time.

Picking stocks isn’t exactly all the rage, but with the sheer volume of discount brokerages and online trading platforms there’s clearly enough interest in the DIY method of investing that it’s easy for people to either manage an entire stock portfolio or dabble in the occasional stock tip. Is this a good idea? Cost wise it’s hardly prohibitive, but from the standpoint of whether this makes for smart investing I have my doubts.

Why? Well, for one thing even the professionals get things wrong sometimes. But the investment industry is staffed with analysts that specialize in entire industries, looking to understand companies from different points of view that reveal opportunities for growth, value or misplaced market opportunities. These people spend their careers trying to understand companies and the industries they are part of.

By comparison the DIY investor tends to act on the things they think they know, and perhaps even the unknown knowns. All of this can lead to serious errors in judgement and costly mistakes in their investments. Are you right to think that Apple is on the decline because it isn’t innovative enough? Or that Microsoft has already lost because of declining computer sales. Is Tesla really worth as much as 50% of GM? Is that hot mining stock you heard about really as good a bet as you think?

In my time working at a mutual fund company I was most impressed when I spoke to portfolio managers who talked about why they looked at companies and industries that no one else did. How much time did you think about mattress companies? How often were you reviewing currency trends between Mexico and India (yes that’s a thing)? How much do you really know about a company?

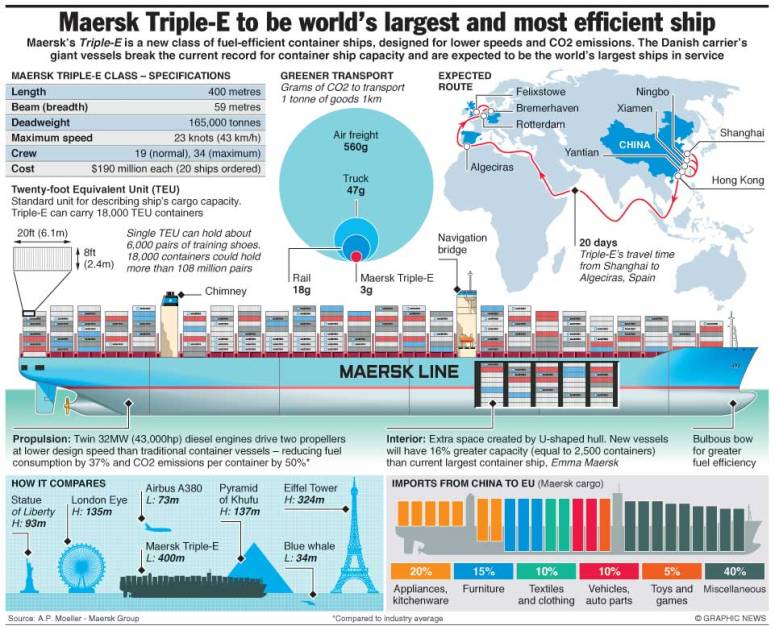

For example, have you ever heard of A.P. Moller-Maersk? It’s okay if you haven’t, but you might be surprised to learn just how big a company it is. Maersk is a Danish corporation that’s core business is global shipping. It’s so large a firm that it accounts for 20% of Denmark’s GDP. It owns and operates countless subsidiaries, including banks, energy companies and supermarkets. It’s full list of associated companies is 12 pages long (Company Overview), showing firms from Angola to Canada, the United States to Japan, on the Middle East and through every Emerging and Developed market you can think of. Maersk commands a shipping fleet of six hundred vessels, making it the world’s largest. It’s revenues in 2011 were $60.2 billion, just shy of Microsoft’s. In 2005 it launched one of its biggest ships, called an E-class, that could carry 15,000 containers. In 2013 Maersk started using its Triple-E Class ship, so large it carries 18,000 containers.*

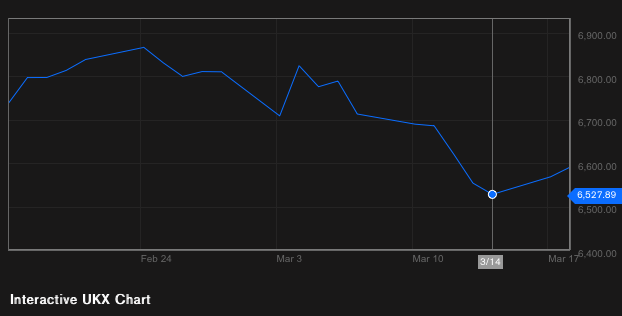

I fully admit to knowing very little about such a large company, and it surprises me that a firm with such reach seems to fly just below the radar. But my job is to help people save for retirement and work with their individual financial situations. That’s why I trust professional analysts and portfolio managers to understand the nuances of the companies that make up the investing world. For the DIY investor all too often rumour and news reports substitute for real knowledge. The good fortune of a stock going up instills courage in stock picking prowess, while a declining market either confuses or robs an investor of their confidence and possibly their savings. Investing is a tricky business, and one where we should seek help when its offered.

*All the information regarding Maersk’s business comes either from their website or the excellent book Ninety Percent of Everything by Rose George, which I highly recommend.