You might have been forgiven if you hadn’t been paying close attention to the Ukrainian Revolution two months ago when it was a long and violent standoff between the Ukrainian government and its people. Kiev square looked like a war zone and reports, while increasingly dire, were not necessarily front page news. But since the toppling of the pro-Russian Ukrainian President Victor Yanukovych it has been impossible to not pay attention to the exploding diplomatic mess of the Crimea.

As of this morning it appears that Vladimir Putin is going to annex the Crimea, much to Ukraine’s dismay, Europe’s frustrations and America’s exhaustion. The crisis is also far from over. The Ukrainian government (now mostly pro-western Europe) is saying that that will not allow such a loss of territory, EU and US sanctions are targeting Russian oligarchs. France is promising to cancel an order of military ships to Russia if Britain punishes Russian billionaire’s living in London. Russia seems relatively unfazed by any of this and seems to know that regardless of what legal reasons may exist that could start a war, few seem interested in shedding blood for the Ukraine.

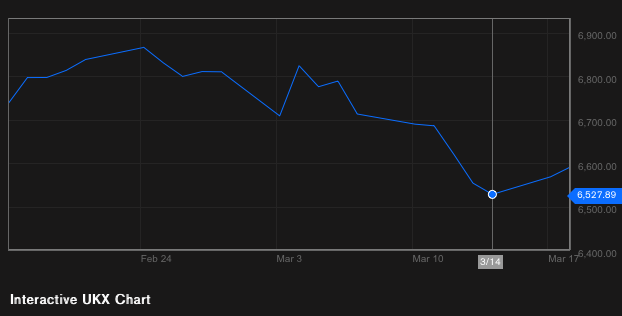

All of this is obviously upsetting markets. Over the last month the global markets, and especially European markets have taken significant hits over concerns that some kind of conflict is about to breakout.

This creates the kind of immediate volatility that is both temporary and is difficult to counter. It’s a reminder that investing is different from day trading. There are people who are willing to try and make profits from the day to day fluctuations of this (most recent) crisis. They will be jumping in and out of the markets, trying to grab the slight differences over each day and profiting from nervous investors. But being an investor means riding out this volatility with the knowledge that while it is uncomfortable, it is ultimately temporary and that real growth comes from long term success, not day to day jitters.

That being said, it would be nice if we didn’t accidentally end the world!

One thought on “Crimean Crisis Reminds Everybody Why Investing is a Long Game”