This summer might prove to be quite rocky for the American and global economies. The smart money is on the Federal Reserve raising its borrowing rate from a paltry 0.25% to something…marginally less paltry. But in a world where borrowing rates are already incredibly low even a modest increase has some investors shaking in their boots.

This summer might prove to be quite rocky for the American and global economies. The smart money is on the Federal Reserve raising its borrowing rate from a paltry 0.25% to something…marginally less paltry. But in a world where borrowing rates are already incredibly low even a modest increase has some investors shaking in their boots.

Why is this? And why do interest rates matter so much? And why should a small increase in the government borrowing rate matter so greatly? The answer has everything to do with that financial black hole 2008.

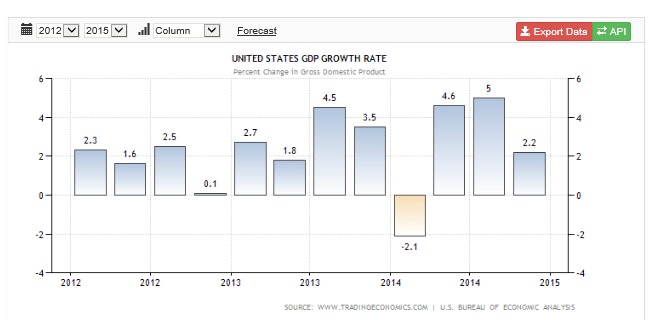

No matter how much time passes we still seem to orbit that particular mess. In this instance it is America’s relative success in returning economic strength that is the source of the woes. Following the crash their was a great deal of “slack” in the economy. Essentially factories that didn’t run, houses that sat empty and office space that was unused. The problem in a recession is convincing 1. Banks to lend to people to start or expand businesses, and 2. to convince people to borrow. During the great depression the double hit of banks raising lending rates and people being unable to borrow created a protracted problem, and it was the mission of the Federal Reserve in 2008 to not let that happen again.

source: tradingeconomics.com

source: tradingeconomics.com

To do that the American government stepped in, first with bailouts to pick up the bad debt (cleaning the slate so to speak) and then with a two pronged attack, by lowering the overnight lending rate (the rate that banks can borrow at) and then promising to buy bonds indefinitely, (called Quantitative Easing). The effect is to print mountains of money, but in ways that should hopefully stimulate banks and corporations to lend and spend on new projects. But such a program can’t go on for ever. Backing this enormous expansions of the treasury requires borrowing from other people (primarily China) and the very reasonable fear is that if this goes on too long either a new financial bubble will be created, or the dollar will become worthless (or both!).

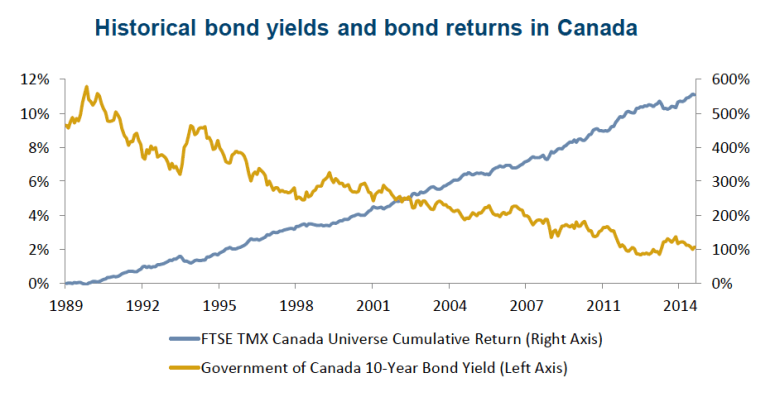

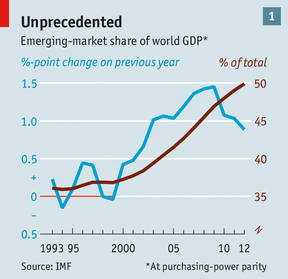

Today the Fed is trying to determine whether that time has come. And yet that answer seems far from clear. Investors are wary that the economy can survive without the crutch of cheap credit. Analysts and economists are nervous that raising rates will push the US dollar higher, making it less competitive globally. Meanwhile other countries are dropping interest rates. Germany issued a negative bond. Canada’s own key lending rates was cut earlier this year. People are rightly worried that a move to tighten lending is going in the exact opposite direction of global trends of deflation. If anything, some argue the US needs more credit.

The question of raising rates reveals just how little we really know about the financial seas that we are sailing. I often like to point to Japan, whose own economic problems are both vast and mysterious. Lots of research has gone into trying to both account for Japan’s economic malaise; it’s high debt, non-existent inflation, and how to resolve it. Currently the Japanese government is making a serious and prolonged attempt to change the country’s twenty year funk, but it is meeting both high resistance and has no guarantee of success.

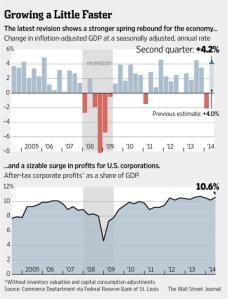

Similarly we have some guesses about what might happen if the Fed raises its rates in the summer or fall. Most of the predictions are temporary instability, but generally the trend is good, raising rates usually correlates to a stronger and more profitable market.

But that’s the key word. Usually. Usually European countries aren’t issuing negative interest rates on their debt. Usually we aren’t in quite a pronounced deflationary cycle. Usually we aren’t buying billions of dollars of bonds every month. Usually.

The answer isn’t to ignore the bad predictions, or obsess over them. The best idea is to review your portfolio and make sure it’s anti-fragile. That means incorporating traditional investment techniques and keeping a steadfast watch over the markets through what are often considered the quiet months of the year.

The answer has everything to do with the rising levels of oil production in the United States combined with what federal regulators are willing to do to encourage new growth.

The answer has everything to do with the rising levels of oil production in the United States combined with what federal regulators are willing to do to encourage new growth.