My industry is awash in optimism. This makes intuitive sense, for the entire process of investing assumes that the companies you invest in will go up in value. Regardless of how conservative and cautious a portfolio manager is, underlying his dour outlook is an optimist that runs a portfolio of various stocks, each one intended to make money.

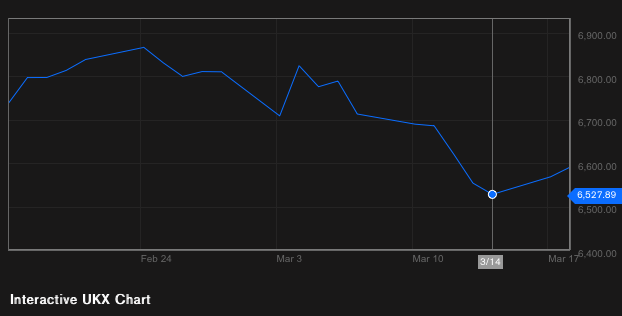

For this reason it is incredibly rare to hear outright negativity from professionals, which I suspect contributes to a subtle sense of unease by the average Canadian who must both trust a portfolio manager to look after his money while scratching their heads at a market that can decline significantly in value with no perceivable change to the asset mix they are invested it.

Even when we do get very negative views from portfolio managers, the subtext is still optimism, just for THEIR investment choices. There is never a contrarian market call that doesn’t seem to serve double duty as a marketing plan as well. When Bill Gross famously said that the US was going to tank back in 2011, he was also claiming that his investments wouldn’t and took a contrarian stance that proved to be very costly for his investors. The same is true for Eric Sprott, whose own doubt about the future of stock markets had prompted some very optimistic numbers about the value of gold and junior mining companies.

For the average investor much of this can be quite exasperating as investing shies away from the ways we attempt to establish certainty. Investing is all about educated guesses, and despite many different tweaks the rules for investing remain surprisingly limited: “buy low, sell high” and “diversify”. Professionals have attempted to improve and refine how these two things are done, seeking out the best ways to analyse companies, markets and whole countries, but in the end these two rules still provide the best advice to investment success.

But as investment guides go, reveling in the uncertainty of the investments is something that many people don’t want. Instead they would much prefer to hear about what is going to happen in a matter-of-fact manner from an “expert”. This is why there is always a market for doomsayers and contrarian predictions, because of the certainty they seem to offer. It feeds our innate sense that there must be a right and knowable answer about the future that can be revealed to us.

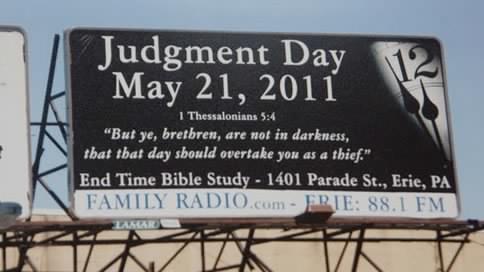

And yet like their biblical equivalents, contrarian predictions have all failed to live up to their hype. Just as every “end is nigh” doomsday cult has disappointedly had to move the calendar date for the end of the world, the number of people who have proclaimed loudly the end of traditional investment world is both numerous and filled with failure.

And yet like their biblical equivalents, contrarian predictions have all failed to live up to their hype. Just as every “end is nigh” doomsday cult has disappointedly had to move the calendar date for the end of the world, the number of people who have proclaimed loudly the end of traditional investment world is both numerous and filled with failure.

And so, frustratingly, investors are faced with the assuredness of doom-saying predictioners (who are almost certainty wrong), and the cheerfully faced optimistic portfolio managers who routinely remind investors that there is no bad time to invest, that bad markets are “corrections” or “set backs” and that significant price drops are “buying opportunities”.

And yet I doubt we would have it any other way. If we could be absolutely certain about what stocks were going up or down and when there would be no money to make in the markets as companies would always be priced correctly. And whether we realize it or not, it is hugely helpful to remember that there exists no accurate way to divine the future, no Ouija board that can contact the dead, no equation or computer that can process the world’s data to tell us what is happening tomorrow, next week or a decade from now.

I derive great comfort in this, because the optimism that drives the investing world is also a wider optimism about the future. Experts predicted famines wiping out millions in 1970s and 1980s, environmentalists predict the end of all things, and political talking heads bombard us with a daily diet that everything is awful, but our world is healthier, wealthier and kinder than ever before. And unbelievably investors believe in that world, even when they don’t know it.