A few days ago a bizarre inversion took place. A single company was suddenly worth more than the entire investable market size of a major economy. While I like Apple a lot and applaud the incredible profitability of the company, this is more a story about how badly the Russian economy is doing.

Back when Russia was first inciting dissent inside the Ukraine following the ouster of the quasi-dictator running the country, it had banked on the idea that it’s continued escalation inside the borders of a sovereign nation would go unchallenged as few countries would wish to risk a military skirmish over a single, marginal country in Europe.

Vladimir Putin miscalculated however when he didn’t realize how precarious the Russian economy was. Sanctions were implemented and what followed was a largely hollow trade war that did more to identify Russia’s weakness than strength. But the most recent blow to Russia has been the change in the price of oil.

Now that the price of oil is under $80, Russia is suffering severely. Like many oil rich nations, oil exports substitute for taxes. This frees autocratic rulers to both pursue generous social programs while not having to answer to citizen complaints about high taxes. It’s how countries like Saudi Arabia and Iran get by with little democratic input and a relatively passive population with little to no public disobedience about democratic rights (mostly).

Now that the price of oil is under $80, Russia is suffering severely. Like many oil rich nations, oil exports substitute for taxes. This frees autocratic rulers to both pursue generous social programs while not having to answer to citizen complaints about high taxes. It’s how countries like Saudi Arabia and Iran get by with little democratic input and a relatively passive population with little to no public disobedience about democratic rights (mostly).

This relationship though means that there are actually two prices for oil. First the breakeven price for extracting oil from the ground, and second break breakeven social price of oil. Those prices are different in every country. In Alberta for instance, tar sand oil is usually quoted at $70 a barrel for breakeven. But to cover the costs of running the government the price is much higher. For Russia the slide in price from $109 a barrel to $80 has meant wiping out it’s current account surplus.

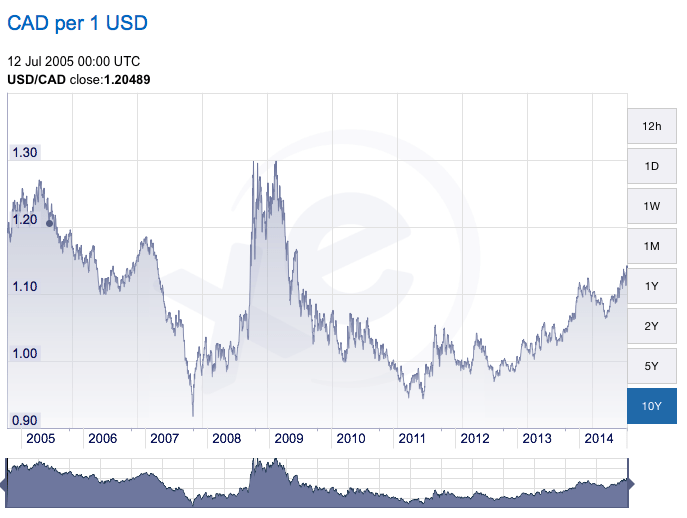

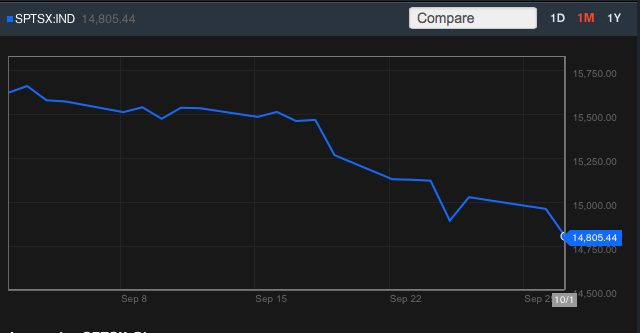

Combined with the falling rouble (now 30% lower than the beginning of the year) and the growth of corporate debt sector, Russia is now in a very precarious situation. I’m of the opinion that energy, and energy companies have been oversold and a rise in price would not be unexpected. But whether the price of energy will bounce back up to its earlier highs from this year seems remote.

Over the last few months I’ve been moving away from the Emerging Markets, and while the reasons are not specifically for those listed above, Russia’s problems are a good example of the choices investors face as other markets continue to improve their health. If you had a dollar today that could be invested in the either the United States or Russia, who would you choose? The adventurous might say Russia, believing they could outlast the risk. But with more Canadians approaching retirement the more sensible option is in markets like the US, where corporate health is improved, debt levels are lower and markets are not subject to the same kind of political, economic and social instability that plagues many emerging economies.

The answer has everything to do with the rising levels of oil production in the United States combined with what federal regulators are willing to do to encourage new growth.

The answer has everything to do with the rising levels of oil production in the United States combined with what federal regulators are willing to do to encourage new growth.