In the hunt for returns in the jungle of investing we rarely talk about “quality of life”, but it should be remembered that the whole reason for investing is precisely that; to preserve and improve one’s quality of life, either through retirement savings, covering and planning for education or making purchasing a house feasible. That’s what this is all for.

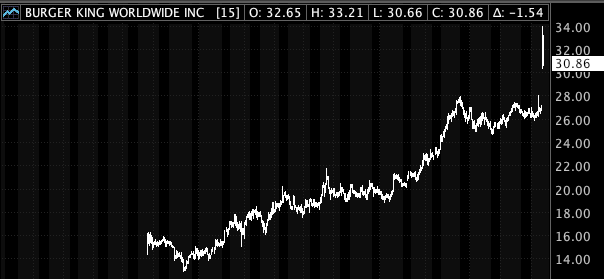

So it’s easy then to get lost in the mechanics of investing. At the charts (see #MarketGlance) the news and the conferences:

https://twitter.com/Walker_Report/status/515164444604006400

This tends to create a disconnect between how we experience the world and how we want our investments to work. For instance I am a big believer in Apple products. (AAPL). I like their phones and computers, I’m in their ecosystem, and as an investor I am impressed at their success as a company. But as a user of an iPhone I’ve started to wonder just how much time I waste under the pretence of having a highly capable phone.

When the iPhone first came to Canada I was struck by the idea that I could look up directions easily, check the internet quickly for information and have access to my emails. When first introduced the iPhone was a tool of productivity. Since then the smart phone market has been flooded and “feature creep” is definitely a term I would use to describe what many of these phones can now do. Meanwhile productivity has taken a backseat to a host of other competing and primarily entertaining functions. In short, I was tired of wasting time on my phone doing nothing.

And along came Blackberry offering, in some ways, a phone that promises to do less fun stuff, and do more work stuff. And while I had shunned Blackberry for years, based largely on my own terrible experience with the older models and their tiny screens, the new Passport seemed to offer me not simply a useful phone for doing work, but also terrible one to watch Netflix on. Because why am I watching Netflix on my phone in the first place?

We live in an age of giant flat TVs with instant movie watching capabilities, but for reasons beyond me I’ve taken to watching stuff on my phone. So while I love Apple, and believe that they have a great company, I’m hoping that I can improve my quality of life by degrading my phone experience somewhat.

Maybe there is hope for Blackberry yet.

Recommended Read: The End of Absence: What We’ve Lost in a World of Connection by Michael Harris